Daily FX Bites 20th July 2023

Welcome to our daily morning FX Bites email. A 30 second snap shot of the key economic releases and risk events that lie ahead from across the global markets. We have kept it concise and clear; however containing all the information you need to ensure you are up –to-date with the latest market moving events in the world of foreign exchange – from economic data releases to the latest central bank speakers.

Today’s Highlights – A quiet session overnight in Asia, with little movement in the currency space. The Australian Dollar is the only outlier, rallying back above 0.68 versus the Dollar on the back of a much stronger Jobs Report out overnight – Employment Change came in at 32.6k in June, versus market expectations of 15k and the unemployment rate come in at 3.5% versus 3.6% expected in Australia.

We have no economic releases of significance out of Europe or the UK today.

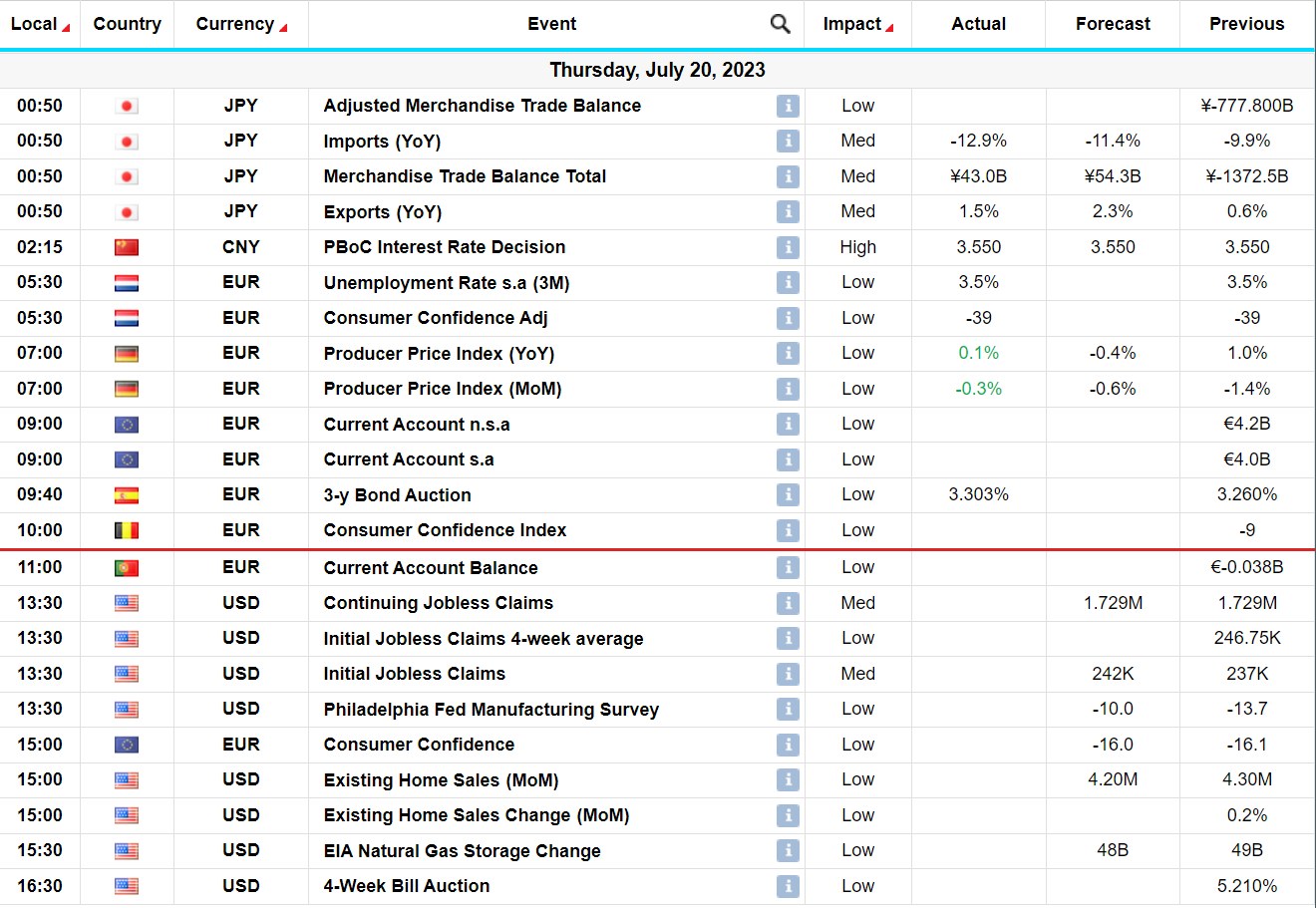

At ‘’ High’’ on the importance scale we have – Existing Home Sales (low impact but is still an important figure to watch) and Initial Jobless Claims out of the US later this afternoon. Housing Starts came in slightly weaker than expected yesterday, adding to the mounting worries over a ‘’softer landing’’ in the US. Existing Home Sales will be closely watched this afternoon to see if this trend continues. Jobless Claims in the US have had significant market impact over the past number of weeks, as the market worries about a softening labour market – helping to compound this recent sell off in the Dollar- again this will be keenly watched this afternoon.

Chart of the Day – GBP/USD has rallied significantly over the course of June and July – over 6% since the beginning of June – see chart below. We topped out just above 1.3140 late last week and we have subsequently seen a 2% sell off. The market is still very much in a sell Dollars mode and will look to add to Dollar shorts on any rallies in the greenback. In saying that GBP/USD needs to close the week back above 1.30 – green line on chart – if we are to see further topside momentum in the Pound versus the Dollar.