Daily FX Bites 26th July 2023

Daily FX Bites 26th July 2023

Welcome to our daily morning FX Bites email. A 30 second snap shot of the key economic releases and risk events that lie ahead from across the global. We have kept it concise and clear; however containing all the information you need to ensure you are up –to-date with the latest market moving events in the world of foreign exchange – from economic data releases to the latest central bank speakers.

What’s Going On?

On Monday we saw a slew of global PMI’s released out of Asia, Europe, the UK and the US for July – giving us the most up-to-date activity data on the global economy. The PMI economic monthly data releases give us a very good insight into the health of the global economies, in both the services and manufacturing sectors – above the 50 level for a PMI release means that the economy is doing well and expanding, below 50 and things are not looking that good. For the UK, the US and Europe yesterday, we did not get one PMI, neither in Services or Manufacturing above the 50 level for July……..!!. Relatively speaking the PMI’s in the US were stronger than the UK and Europe, with Europe printing the weakest amongst its peers. Hence we have seen EUR/USD trade below major support at 1.11/1.1090 yesterday and GBP/USD sell off however to a lesser extent.

Yesterday morning we have had German IFO Business Confidence Index released – coming in at 87.3 versus market expectations of 88.0. Again this has helped compound the PMI figures out of Europe on Monday and has seen further selling pressure in the Euro.

In contrast to this we had Consumer Confidence out of the US yesterday afternoon – market expectations had this release at 112.00, however it came out at a massive 117.00 – once again highlighting the recent dichotomy between Europe and the US.

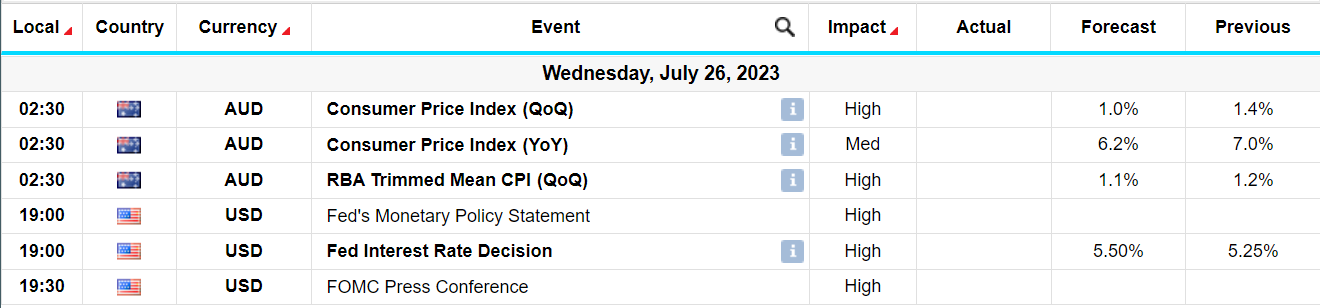

At ‘’ V High’’ on the importance scale we have – The Federal Reserve Interest Rate Decision at 7.00pm London time – Our base case however is that the Fed will hike by 0.25% to 5.50% and maintain its tightening bias at the July meeting. Chair Powell is likely to suggest that a follow-up hike is possible at the next meeting in September, but will emphasize that no decision has yet been made, and will depend on the substantial inflation and jobs data in the interim period. The market impact of this messaging is likely to be modestly hawkish.

Chart of the Day

EUR/USD has sold off its highs from Monday of last week, which saw it trade above 1.1250 level – red line on chart. We have subsequently seen a slight reversal in the Dollar’s fortunes, as it has strengthened across the board. This has been further compounded versus the Euro on the back of much weaker PMI’s out of Europe on Monday, a weak IFO number of out Germany yesterday and a technical break of major support at 1.11/1.1090 – see green line on chart.