Daily FX Bites 4th August 2023

|

|

Daily FX Bites 4th August 2023

|

* For further data please select the calendar above. |

|

|

What’s Going On?

|

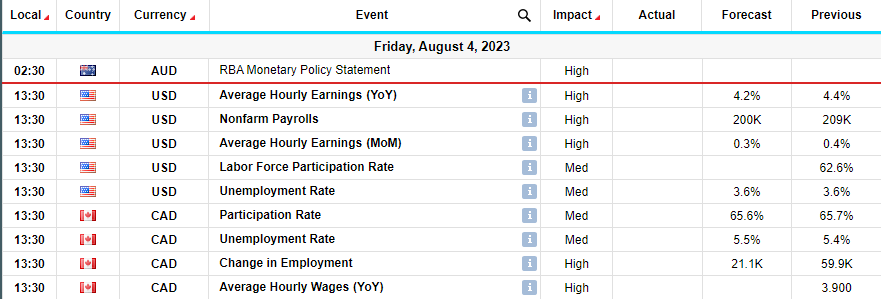

Today’s Highlights – Yesterday’s decision by the Bank of England to raise interest rates by 0.25% to 5.25% was in line with market expectations. As a result, the value of the British Pound dropped against both the US Dollar and the Euro. GBP/USD reached a low of 1.2621, while EUR/GBP reached a high of 0.8655 during intra-day trading. However, after carefully analysing the BOE statement and the governor’s press conference, investors regained confidence in the Pound. GBP/USD stabilized at around 1.27, and EUR/GBP traded back down towards 0.8600. Governor Bailey’s press conference was perceived as more balanced, and as a result, the market is still pricing in another 0.25% interest rate hike in September. It is worth noting that there has been a reassessment of the terminal interest rate in the UK, which refers to the rate at which the market believes the BOE will stop increasing interest rates. This rate now stands at 5.75%, down from its previous high of over 6.5% a few months ago. In addition to these developments, today’s focus is on the US Jobs Report, which is traditionally the most important economic release of each month. It provides data on job creation, the unemployment rate, and average hourly earnings for the previous month. Given the current strength of the US Dollar, a strong release today is expected to further boost the currency against other G10 currencies. Both EUR/USD and GBP/USD are hovering around significant support levels at 1.09 and 1.2621 respectively, which adds even more significance to today’s release. The consensus among analysts is that non-farm payrolls will consolidate June’s slower pace, with an expected creation of 200,000 jobs in July after the previous month’s 209,000. The unemployment rate, as measured by the household survey, surprised many by remaining unchanged at 3.6% in June. It will be interesting to see if this trend continues. Overall, the economic landscape is constantly evolving, and it is crucial for us to stay informed and adapt our strategies accordingly. At the top of the importance scale, we have the highly anticipated US Jobs Report this afternoon. This report, which is released on the first Friday of each month, is traditionally considered the most significant economic release. It provides crucial insights into the previous month’s job creation, unemployment rate, and average hourly earnings, making it a key indicator of the overall health of the US economy. Given the current strength of the US Dollar, a strong release today is expected to solidify its position and propel it higher against other G10 currencies. The EUR/USD pair is currently hovering near a critical support level at 1.09, while the GBP/USD pair is testing yesterday’s lows at 1.2621. These levels hold immense significance, adding to the anticipation surrounding today’s release. Analysts predict that non-farm payrolls will consolidate the slower pace seen in June, with an expected creation of 200,000 jobs in July following the previous month’s 209,000. The unemployment rate, as measured by the household survey, surprised many by remaining unchanged at 3.6% in June. It will be interesting to see if this trend continues. The outcome of today’s US Jobs Report will undoubtedly have a significant impact on the currency markets, and we must closely monitor any resulting trends or shifts. |

Chart of the Day

|

The EUR/USD is currently resting on a crucial support level at 1.09, as indicated by the red line on the chart below. It would be of great significance if there is a break and weekly close below this level, especially considering the impact of a strong US Jobs Report. |

|

|

|

|

|

Treasury First is powered by Assure Hedge (UK) Limited, a company incorporated in England and Wales (No.10723112) with its registered office at 45 Eagle Street, London WC1R 4FS, UK, is authorised and regulated by the Financial Conduct Authority of the UK (FRN:783837). Assure Hedge Limited, the parent company, is incorporated in Ireland (No. 578153) with its registered office at Dogpatch Labs, CHQ Building, North Wall Quay, Dublin 1, Ireland. This email and any files transmitted with it are confidential and intended solely for the use of the individual or entity to whom it is addressed. If you have received this email in error, immediately notify the sender by reply email and then permanently delete this email and your reply. Unauthorised use, disclosure, storage or copying of this email is not permitted. Whilst every endeavour is taken to ensure that emails are free from viruses, no liability can be accepted for any damage arising from using this email. Treasury First does not guarantee the accuracy or reliability of information in this message, and any views expressed are not necessarily the views of the company. |