RISK EVENT – US Inflation Data – 13th Feb 2024

RISK EVENT – US Inflation Data – 13th Feb 2024

Event – US Inflation Data

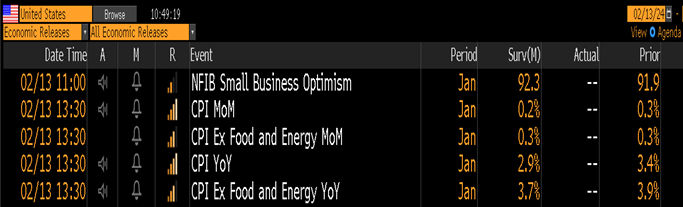

Time – 1.30pm London time

Economist’s Expectations –

Importance – Very High

Implied Volatility – High

Certainty surrounding the economic release – Moderate

What’s going on?

UK and Sterling – In what has to be classified as very dull currency markets, Sterling is standing out amongst its peers. As highlighted last week, we get a series of UK economic data releases over the course of the next few days which should provide us with a real insight into the direction of play for both EUR/GBP and GBP/USD. The first of these data points were released this morning with the UK Employment Report. The UK Jobs Report come in much better that expected across the board – beating market expectations on all accounts. This saw the Pound rally versus G10 currencies – with GBP/JPY now at fresh post Brexit highs, GBP/CHF extending aggressively past 1.1060 and it feels like a matter of time before EURGBP breaks below the all-important support at 0.8510-00. Tomorrow we get the UK’s inflation report and Thursday we get the GDP release. Further strong outcomes here and the Pound should outperform – particularly versus the Euro and CHF. Weather we can push higher versus the Dollar will of course depend on this afternoon’s US Inflation report.

What the markets are looking for today – US Inflation data

The US Inflation Report today comes after the significant trimming of Federal Reserve interest rate cut expectations in the markets following the bumper payrolls report on Feb 2nd and a succession of Fed members calling for patience from the markets regarding interest rate cuts. Consensus sees core CPI print another 0.3% M/M in January and Friday’s seasonal revisions shouldn’t have materially swayed these estimates. Core CPI was revised down from 0.31 to 0.28% M/M in Dec but with the three-month average unchanged at 3.3% annualized. Core services were revised lower meanwhile, including the “supercore” down from 4.3% to 4.0% annualized over three months. It still sees a large wedge to the PCE supercore though, tracking 2.2% annualized in December (prior to revisions). As such, specific CPI implications for PCE are again likely to help set the tone for market reaction.

Outcomes –

This afternoon’s data release will be pretty binary when it comes to the Dollar and where EUR/USD and GBP/USD finish the day. A strong inflation figure and the Dollar rallies versus G10, a weaker one and we sell off. It does feel however that the currency markets will be impacted more significantly on a weaker figure = lower Dollar.

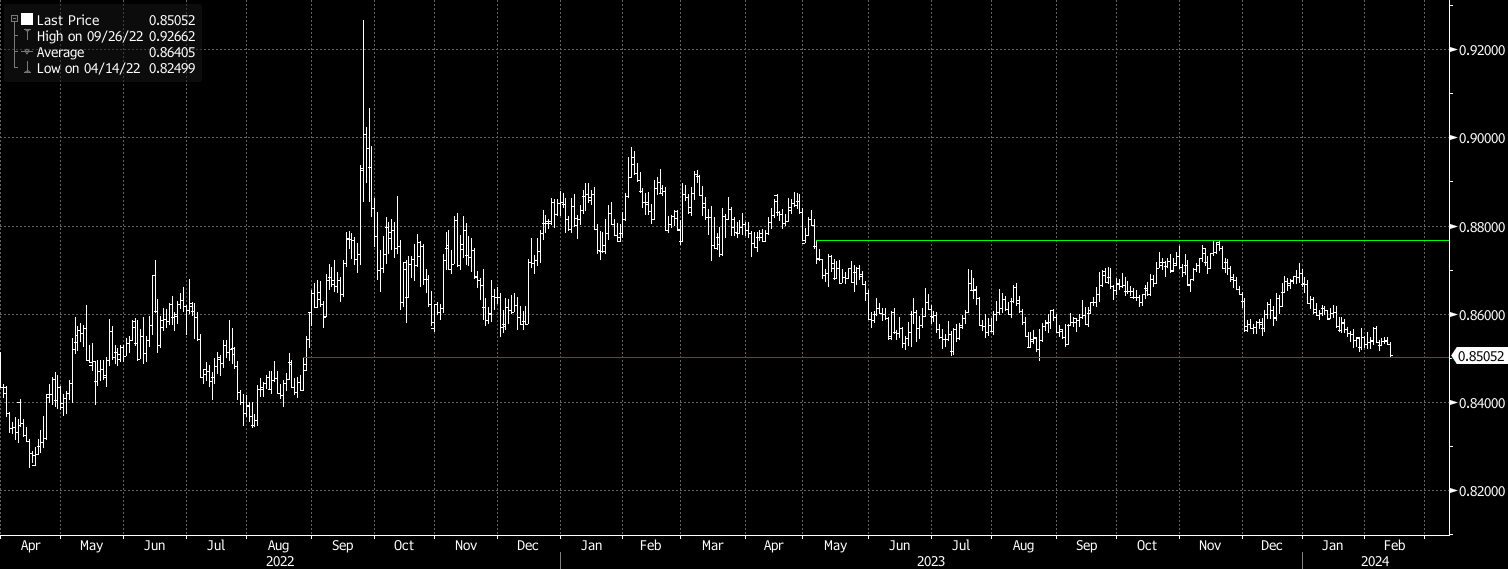

EUR/GBP – The cross sits right on major support post better than expected UK Jobs Report this morning – red line on chart. We have not been below this support for 18 months – a break and weekly close below would be very significant.