Week Ahead 8th April – 12th April 2024

The Week Ahead –

What’s Going On?

As highlighted throughout our reports so far this year the currency markets have been stuck in tight ranges, with the dominant theme being Dollar strength – which is in complete contrast to the end of 2023, when the Dollar was on the back foot. Overall ranges remain intact so far this year in the currency markets; however intra-week volatility is increasing as we approach some important central bank meetings, which should differentiate the stronger currencies from the weaker ones, as certain countries cut interest rates ahead of others. Last week saw the US once again demonstrating its exceptionalism ahead of its peers, with ISM beating the markets expectations and Friday seeing a very strong jobs report. A stronger than expected inflation report this Wednesday out of the US could kick the now expected first interest rate cut from June to further down the line.

Both the Euro and the Pound remain down towards the lower half of their yearly ranges versus the Dollar and have failed to regain the 1.09 and 1.27 levels respectively. EUR/GBP continues to hold above 0.8550 for the majority of last week, however the Euro could come under renewed pressure versus the Pound this week with the ECB meeting on Thursday, which should be dovish, signalling to the market that the first 0.25% interest rate cut will come at the following ECB meeting in June.

Performance of G10 currencies versus the Dollar last week –

EUR/USD – up 1.15%

GBP/USD – up 0.8%

AUD/USD – up 1.6%

USD/JPY – up 0.6%

Levels in G10 to watch this week –

EUR/USD – Having broken the 1.0800 support level last week, we traded to a low of 1.0725 and subsequently bounced of this level, in what was a volatile week of currency markets. The topside resistance now comes in at 1.0885-95 and 1.0725 is now the downside target.

EUR/GBP – we still have not traded convincingly above 0.8600 level in EUR/GBP and we need to break above the 100 and 200 day moving averages that come in around 0.8585-0.8605 this week to indicate further topside momentum. 0.8500 still remains the major support level below.

GBP/USD – As with EUR/USD we broke below the major support in Cable at 1.2600, trading to a low of 1.2540 last week before bouncing hard. A move back above 1.2700 is now needed to ensure we do no continue the downtrend.

Week Ahead –

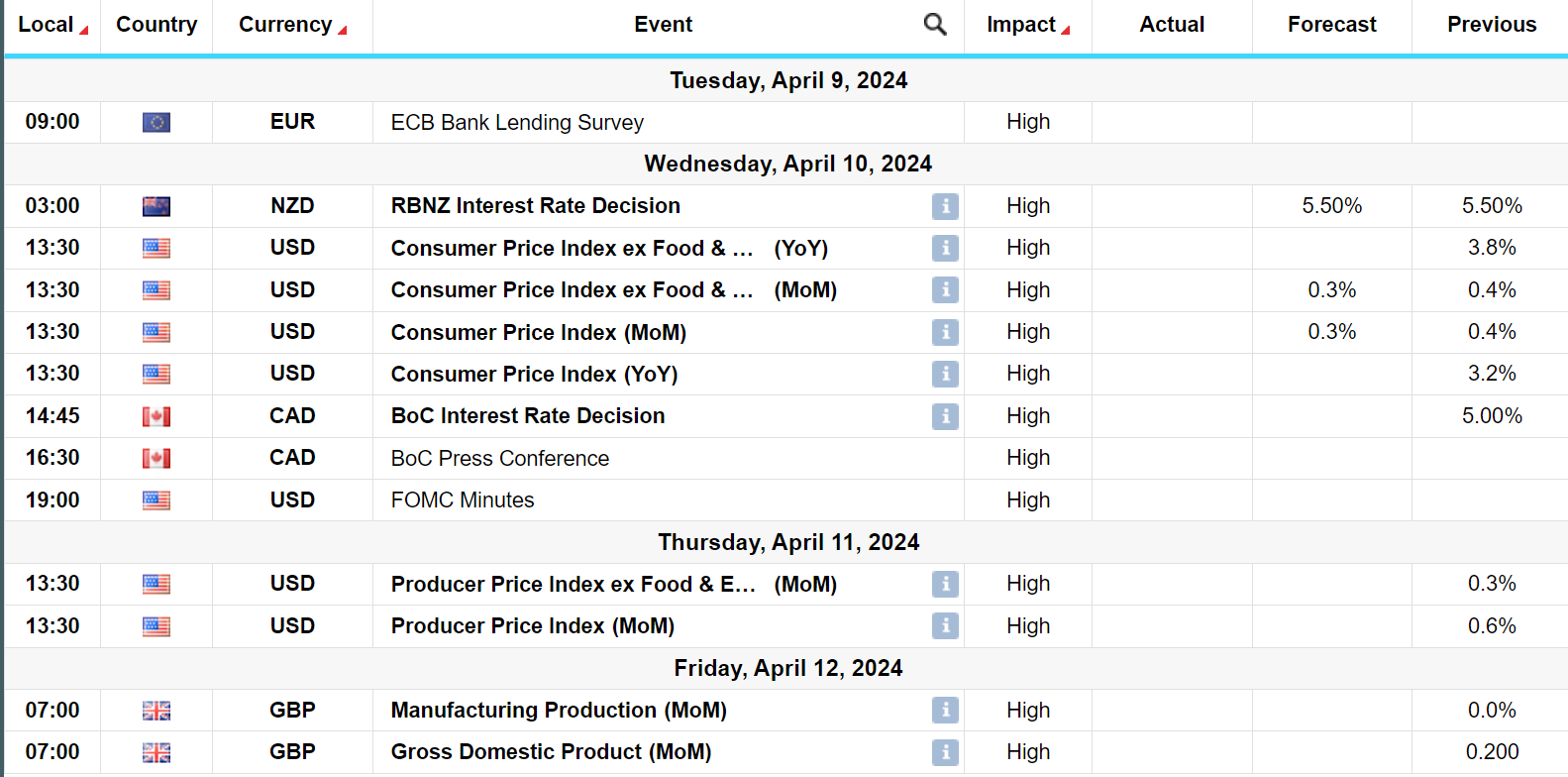

We have plenty of central bank interest rate decision meetings this week, with the New Zealand, Canadian and ECB meetings all on the cards.

On Wednesday we have interest rate decisions in New Zealand. The RBNZ will most likely be on hold and there appears to be a high bar for them to shift rates in either direction for now. We expect them to leave interest rates again at 5.5% where they have been since May last year.

Also on Wednesday we have interest rate decisions in Canada – The Bank of Canada is again seen holding its policy rate at 5%, although odds have grown that it at least partially paves the way for a first cut in June.

Wednesday’s US CPI report for March provides the main data interest of the week and could help set the tone for the May 1 FOMC decision despite being so far out. The surprise acceleration in core CPI and PCE measures over the first two months of the year has for the most part seen FOMC participants have less confidence in a sustainable return to 2% inflation.

The ECB is unanimously expected to leave rates on hold at its April meeting, with most focus on the framing of communication surrounding a likely rate cut in June. Markets are almost fully pricing a first 25bp rate cut in June, and recent ECB communication has seen Governing Council members across the hawk-dove spectrum seemingly converge towards this meeting as the likely candidate to begin its easing cycle.

Chart of the Day – Bitcoin – Worth keeping an eye on Bitcoin this week to see if it can make fresh all-time highs – $72,910 is the target – red line on chart.