Month: July 2023

Daily FX Bites 26th July 2023

Daily FX Bites 26th July 2023

Welcome to our daily morning FX Bites email. A 30 second snap shot of the key economic releases and risk events that lie ahead from across the global. We have kept it concise and clear; however containing all the information you need to ensure you are up –to-date with the latest market moving events in the world of foreign exchange – from economic data releases to the latest central bank speakers.

What’s Going On?

On Monday we saw a slew of global PMI’s released out of Asia, Europe, the UK and the US for July – giving us the most up-to-date activity data on the global economy. The PMI economic monthly data releases give us a very good insight into the health of the global economies, in both the services and manufacturing sectors – above the 50 level for a PMI release means that the economy is doing well and expanding, below 50 and things are not looking that good. For the UK, the US and Europe yesterday, we did not get one PMI, neither in Services or Manufacturing above the 50 level for July……..!!. Relatively speaking the PMI’s in the US were stronger than the UK and Europe, with Europe printing the weakest amongst its peers. Hence we have seen EUR/USD trade below major support at 1.11/1.1090 yesterday and GBP/USD sell off however to a lesser extent.

Yesterday morning we have had German IFO Business Confidence Index released – coming in at 87.3 versus market expectations of 88.0. Again this has helped compound the PMI figures out of Europe on Monday and has seen further selling pressure in the Euro.

In contrast to this we had Consumer Confidence out of the US yesterday afternoon – market expectations had this release at 112.00, however it came out at a massive 117.00 – once again highlighting the recent dichotomy between Europe and the US.

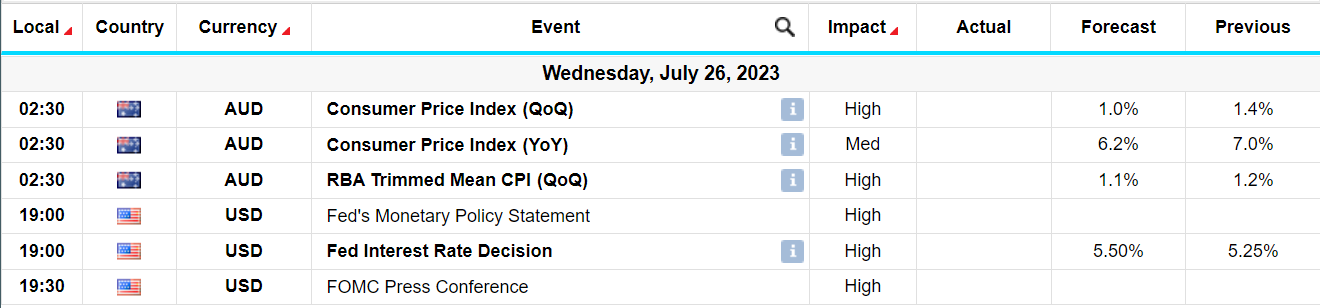

At ‘’ V High’’ on the importance scale we have – The Federal Reserve Interest Rate Decision at 7.00pm London time – Our base case however is that the Fed will hike by 0.25% to 5.50% and maintain its tightening bias at the July meeting. Chair Powell is likely to suggest that a follow-up hike is possible at the next meeting in September, but will emphasize that no decision has yet been made, and will depend on the substantial inflation and jobs data in the interim period. The market impact of this messaging is likely to be modestly hawkish.

Chart of the Day

EUR/USD has sold off its highs from Monday of last week, which saw it trade above 1.1250 level – red line on chart. We have subsequently seen a slight reversal in the Dollar’s fortunes, as it has strengthened across the board. This has been further compounded versus the Euro on the back of much weaker PMI’s out of Europe on Monday, a weak IFO number of out Germany yesterday and a technical break of major support at 1.11/1.1090 – see green line on chart.

Daily FX Bites 21st July 2023

Welcome to our daily morning FX Bites email. A 30 second snap shot of the key economic releases and risk events that lie ahead from across the global. We have kept it concise and clear; however containing all the information you need to ensure you are up –to-date with the latest market moving events in the world of foreign exchange – from economic data releases to the latest central bank speakers.

What’s Going On?

Today’s Highlights – The Dollar continues its recovery this week lead by USD/JPY and GBP/USD. A weaker Inflation Report out of the UK earlier in the week was the catalyst for Sterling to sell off versus the Dollar and GBP/USD remains below the all-important 1.2950/1.30 level. This Dollar strength has fed into EUR/USD as well – trading off its highs seen last week above 1.1250 and currently trading down towards the 1.11 level.

We have just had the following comments from the Bank of Japan this morning –

-BOJ IS SAID TO SEE LITTLE NEED TO ACT ON YIELD CONTROL FOR NOW

-BOJ IS SAID STILL NOT CONFIDENT ABOUT HITTING PRICE GOAL STABLY

This takes any chance of a shift in monetary policy at next week’s Bank of Japan meeting off the table and has sent USD/JPY nearly 1% higher. This should add to further Dollar strength in the G10 space over the course of today’s session.

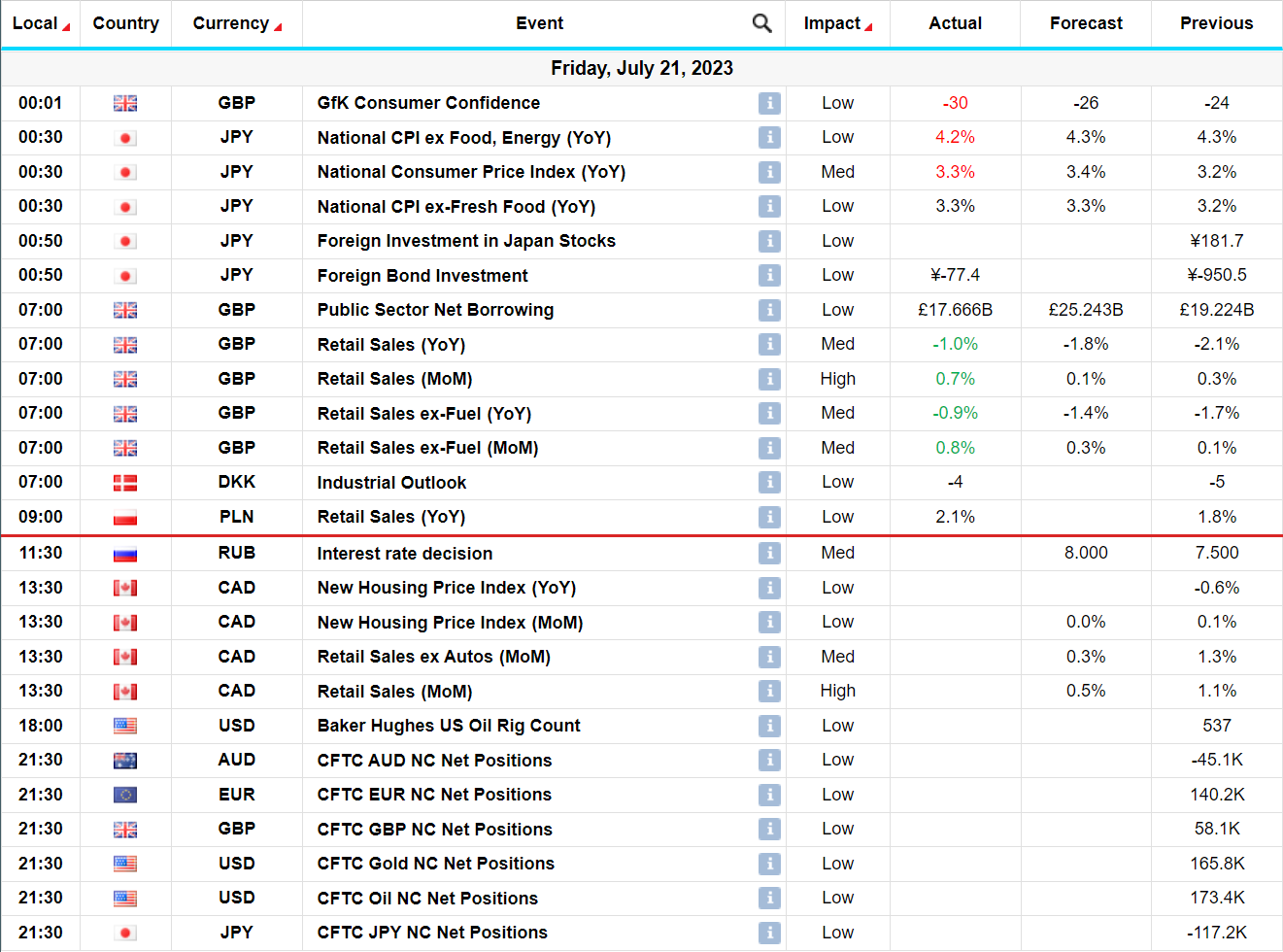

At ‘’ High’’ on the importance scale we had – Retail Sales out of the UK this morning at 7.00am. We had a better than expected print for retail sales across the board. That’s now 5/6 prints this year surprising to the upside. We initially saw Sterling strength, however the larger Dollar strength theme has subsequently taken over and the Pound has sold off versus the Dollar.

Chart of the Day – Initial Sterling strength on the back of stronger Retail Sales out of the UK this morning, however the larger Dollar theme has subsequently taken off.

Daily FX Bites 20th July 2023

Welcome to our daily morning FX Bites email. A 30 second snap shot of the key economic releases and risk events that lie ahead from across the global markets. We have kept it concise and clear; however containing all the information you need to ensure you are up –to-date with the latest market moving events in the world of foreign exchange – from economic data releases to the latest central bank speakers.

Today’s Highlights – A quiet session overnight in Asia, with little movement in the currency space. The Australian Dollar is the only outlier, rallying back above 0.68 versus the Dollar on the back of a much stronger Jobs Report out overnight – Employment Change came in at 32.6k in June, versus market expectations of 15k and the unemployment rate come in at 3.5% versus 3.6% expected in Australia.

We have no economic releases of significance out of Europe or the UK today.

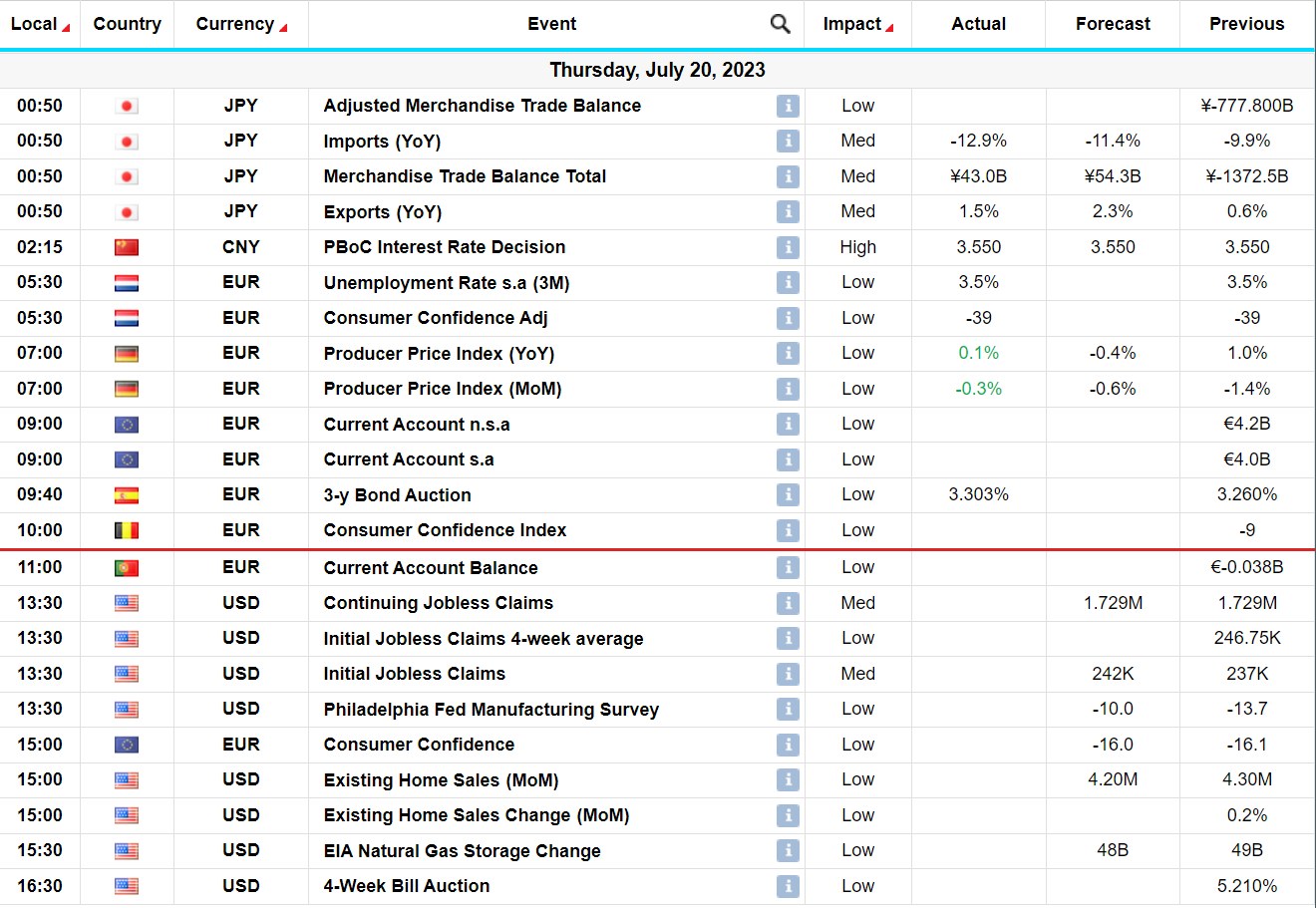

At ‘’ High’’ on the importance scale we have – Existing Home Sales (low impact but is still an important figure to watch) and Initial Jobless Claims out of the US later this afternoon. Housing Starts came in slightly weaker than expected yesterday, adding to the mounting worries over a ‘’softer landing’’ in the US. Existing Home Sales will be closely watched this afternoon to see if this trend continues. Jobless Claims in the US have had significant market impact over the past number of weeks, as the market worries about a softening labour market – helping to compound this recent sell off in the Dollar- again this will be keenly watched this afternoon.

Chart of the Day – GBP/USD has rallied significantly over the course of June and July – over 6% since the beginning of June – see chart below. We topped out just above 1.3140 late last week and we have subsequently seen a 2% sell off. The market is still very much in a sell Dollars mode and will look to add to Dollar shorts on any rallies in the greenback. In saying that GBP/USD needs to close the week back above 1.30 – green line on chart – if we are to see further topside momentum in the Pound versus the Dollar.