Month: November 2023

Daily FX Bites 30th November 2023

Welcome to our daily morning FX Bites email. A 30 second snap shot of the key economic releases and risk events that lie ahead from across the global. We have kept it concise and clear; however containing all the information you need to ensure you are up –to-date with the latest market moving events in the world of foreign exchange – from economic data releases to the latest central bank speakers.

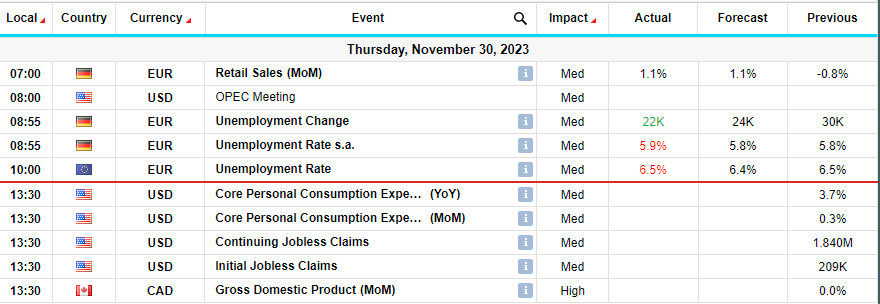

Economic Table

Seeing Increased Volatility in the FX markets

The dominant theme in the FX markets is Dollar weakness, with the majority of the FX mayors rallying against the greenback. The perceived wisdom here is that the US Federal Reserve is done hiking interest rates and will not hike at their December meeting – US interest rates are currently at 5.50%. US yields have sold off considerable over the month of November – 10 year US interest rates are at 4.27% having traded above 5.0% in October. This loss of yield and softening US economic data has seen the Dollar sell off on average 4.5% versus G10 currencies.

This morning we have seen a slight reversal in this lower Dollar trend, particularly versus the Euro, as the Dollar has rallied on the back of weaker than expected inflation report out of France and Germany and then the Eurozone wide release. We have also seen the Euro selloff against Sterling on the back of these economic figures – with EUR/GBP breaking through very decent support at 0.8650 and trading to a low of 0.8617 so far.

Eurozone core inflation came in at 3.6% year on year versus market expectations of 3.9% – an impressive decrease from 5.7% in March of this year.

Day’s Highlights –

At ‘’ High’’ on the importance scale this afternoon we have – Chicago PMI – this is a very good activity indicator for the US economy and it will be monitored closely – 46.00 is expected by the markets.

Major levels to keep an eye on this week –

EUR/USD – All eyes on the physiological level at 1.1000 which we have broken briefly this week already – Euro has sold off this morning on the back of weaker than expected inflation figures – the first downside level of note is 1.0900- 1.0890 support.

GBP/USD – GBP/USD is outperforming the single currency and although it has sold off from the initial break of 1.27 earlier this week, it is holding onto its gains versus the Dollar and remains above decent support at 1.2600

EUR/GBP – As mentioned above – GBP/USD is outperforming EUR/USD and this has led to an interesting subplot in EUR/GBP. For the past number of weeks EUR/GBP threatened to break out above 0.88, as we trade on a high 0.87 handle. Better than expected UK data, has seen this trend reverse, as we trade back below 0.87 and on the back of weaker than expected Eurozone inflation figures this morning we have finally broken through the 0.8650 support trading to a low of 0.8617 so far.

Chart of the Day – EUR/USD

EUR/GBP– see below a 6 month chart of EUR/GBP – we have sold off some 1.7% in EUR/GBP over the past 10 days, trading below significant support and pivot zone at 0.8650 – see green line on chart. The low so far on this move this morning has been 0.8617, matching the lows seen towards the end of Sept –see circles on chart – a break and daily close below 0.8600 would be very significant.

Daily FX Bites 15th November 2023

Welcome to our daily morning FX Bites email. A 30 second snap shot of the key economic releases and risk events that lie ahead from across the global. We have kept it concise and clear; however containing all the information you need to ensure you are up –to-date with the latest market moving events in the world of foreign exchange – from economic data releases to the latest central bank speakers.

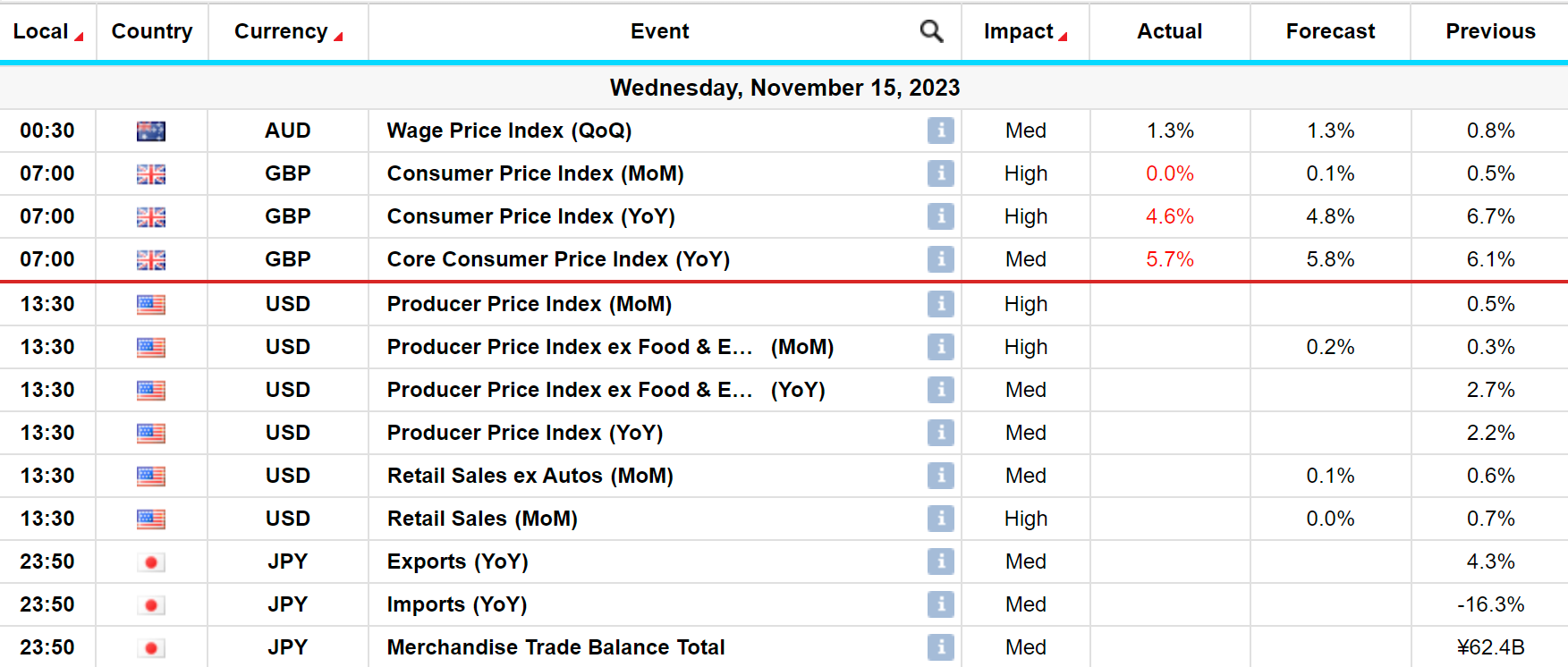

Economic Table

The FX markets woke up yesterday…….

Plenty to get our teeth into this morning in the foreign exchange markets, following 4-6 weeks of pretty dull ranges it has to be said. As highlighted yesterday in our ‘’Risk Report’’ the US Inflation Report proved very meaningful indeed and had a huge impact on the FX markets. The inflation figure in the US came in slightly weaker than expected, with the month on month figure coming in at 0.0% versus market expectations of 0.1% – a small miss, however a meaningful one nonetheless. Essentially this dip in US inflation has greatly reduced the probability of a further interest rate hike in the US in Dec and has subsequently led to a weaker Dollar across the board. The likes of EUR/USD, GBP/USD and AUD/USD have broken some significant levels now on the topside, taking us out of our recent ranges and we await and see if these moves are sustainable into the weekend and beyond.

This morning we had Industrial Production and Retail Sales out of China – both coming in slightly above expectations, which of course is a positive sign for the overall global economy.

We also had inflation figures out of the UK this morning – again, like we are seeing globally – they came in below the market’s consensus – this has been seen as an overall positive for the UK economy and Sterling has managed to hold onto most of its gains, particularly versus the Dollar, from yesterday.

Day’s Highlights –

At ‘’ High’’ on the importance scale this afternoon we have – Retail Sales out of the US – the market is looking for a weaker figure here, which of course will help compound yesterday’s weak inflation report

At ‘’ High’’ on the importance scale this afternoon we have – PPI out the US also – again a slightly weaker figure here month on month is expected – if this is the case again it will highlight the softening US economy.

Major levels to keep an eye on this week –

EUR/USD – EUR/USD broke the all-important 1.08 resistance level yesterday afternoon, trading to a high of 1.0888 overnight. We now look to see how it trades over the coming sessions and whether we see a mean reversion or not – ideally if this uptrend in EUR/USD is to continue, the old resistance at 1.08/turned new support should hold and the market should buy EUR/USD into this zone.

GBP/USD – As was the case with EUR/USD yesterday afternoon, GBP/USD broke through firm resistance at 1.2440 – a level which had capped us since early Sept, trading to a high of 1.2506 this morning. Again this 1.2440 level should attract further buyers who had missed the initial rally yesterday.

EUR/GBP – Given this is a Dollar move – EUR/GBP is somewhat side lined during these moves – it does remain however on a 0.87 handle and until we can break back below 0.8650 – the danger remains to the topside

Chart of the Day – EUR/USD

A chart of EUR/USD from July of this year. EUR/USD sold off some 7.50% from July of this year to early Oct. Since the lows in Oct we have seen a 4.20% rally and as mentioned above we took out the 1.08 level yesterday afternoon – convergence of yellow and green line on the chart below. If we retest and hold this 1.08 level, the probability for a move towards 1.10 over the coming weeks is hugely increased.