Month: February 2024

Week Ahead 26th Feb-1st March 2024

The Week Ahead –

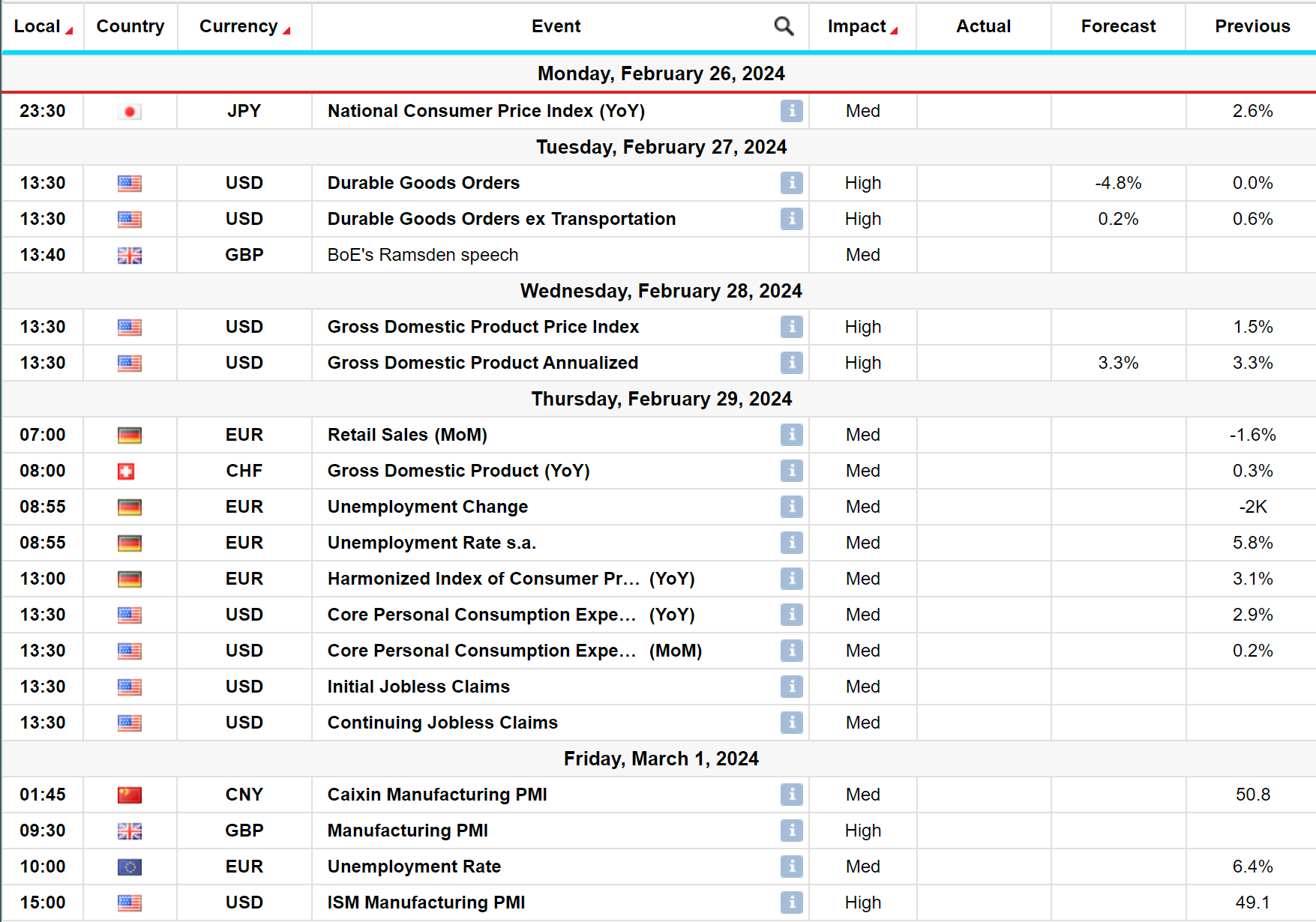

Economic Table

What’s Going On?

As highlighted throughout our reports so far this year the currency markets have been stuck in tight ranges, with the dominant theme being Dollar strength – which is in complete contrast to the end of 2023, when the Dollar was on the back foot. The root cause of this Dollar strength and lacklustre FX markets boils down to global central banks and the timing of interest rate cuts. The financial markets had nailed their colours to the mast in the final quarter of 2023, calling for a deterioration of US economic data and an interest rate cut by the Federal Reserve by March of 2024. Hence the market has positioned itself for a weaker Dollar, which saw the likes of EUR/USD and GBP/USD rally into year end. The market got this spectacularly wrong – US economic data has outperformed its peers since Jan 1st and the Federal Reserve in the US has categorically stated that they are not going to cut interest rates in March. This has led to a liquidation of positions build up into the end of 2023 and a complete reversal of the weaker Dollar trend in the currency markets.

It’s always a dangerous game when the financial market attempt to accurately predict the precise timing of interest rate cuts by central banks and it can lead to choppy, directionless markets in the lead up to it – unfortunately that is what we are now experiencing in the FX markets – with a bias of overall Dollar strength.

The other theme that has emerged this year so far is Sterling strength, particularly in the Sterling crosses – with the likes of GBP/EUR, GPB/CHF and GBP/JPY all trading towards the top of their 18 month range. GBP/EUR needs to break the 1.1765 or in EUR/GBP terms the 0.8500 level to garner further momentum for the Pound.

Levels in G10 to watch this week –

EUR/USD – 1.0900 remains the elusive topside level in EUR/USD – 1.0898 the high so far this month – back below 1.0750 and we should see further Euro weakness, Dollar strength.

EUR/GBP – It’s all about the 0.8500 support level in EUR/GBP – a break of here and we will see fresh 18 month lows and further Sterling strength. Back above 0.8650 and something significant has changed in these markets.

GBP/USD – Whilst the Pound has done well versus the majority of G10 currencies this year, it still struggles against the Dollar. 1.2800 is the topside level to break, which could see GBP/USD run towards 1.3000 level. Back below 1.2560-50 zone and we would begin to get worried regarding the Pound.

Week Ahead –

It’s a quiet start to the week; however things get a little busier in the latter half, which could bring some excitement to the currency markets.

The week kicks off on Wednesday with the Reserve Bank of New Zealand’s interest rate decision. We expect the RBNZ to leave rates on hold at 5.5% at its February 28th meeting even though the labour market data were stronger than expected. It has been on hold since it last hiked in May last year.

On Thursday/Friday we get Eurozone inflation figures – The Eurozone February flash inflation round begins with France, Spain and Germany. The Eurozone-wide estimate is released at 1000GMT/1100CET on Friday, with an early consensus looking for core inflation at 2.9% Y/Y (vs 3.3% prior) and headline at 2.5% Y/Y (vs 2.8% prior)

Again on Thursday we get the January PCE deflator from the US. This will be the last reading of the Fed’s preferred inflation gauge before its March interest rate decision meeting, so it will be eagerly watched by the markets.

Chart of the Day – Bitcoin – it’s worth highlighting that the Dollar is not strengthening against everything – with Bitcoin rallying over 112% since Oct of last year – see chart below.

GBP – UK Economic Data – A focus on Sterling – GBP/USD and EUR/GBP

A focus on Sterling – GBP/USD and EUR/GBP

What’s going on in the FX markets?

The currency markets remain in a tricky environment, as we move from one risk event to the next, desperately trying to find some insight and direction. We highlighted at the beginning of the year that the financial markets were putting themselves in a dangerous position, as they attempted to predict the timing of the first interest rate cuts by the major global central banks. The financial markets had the first interest rate cut priced in by the US Federal Reserve for March of this year and had positioned themselves in the currency markets and Fix Income markets accordingly. The markets have got this spectacularly wrong and it now looks more likely to be May if at all then. This has led to choppy, directionless markets, with the Dollar experiencing large periods of strength – very much against what the markets were looking for going into this year.

Despite the dominance of the Dollar so far this year, GBP/USD has held up relatively well towards the upper half of its previous 12 month range. Sterling crosses – so the likes of GBP/EUR, GBP/CHF, GBP/JPY have all fared very well so far this year, with GBP/EUR up towards the upper end of its 18 month range.

Last week’s slew of UK economic data was meant to set the scene for a higher Pound across the board, however it ended up painting a very mixed picture of the economy, with both the inflation and GDP figures coming in weak and activity data registering beats. Looking through it all though, the data suggested that the macro backdrop is evolving quite well for the UK and the markets are looking for the first interest cut in the UK in August now. This would mean that the UK would be one of the last G10 central banks to cut interest rates.

With this in mind, the Pound should fare well against its G10 counterparts and we do feel GBP/USD will perform well in the coming weeks.

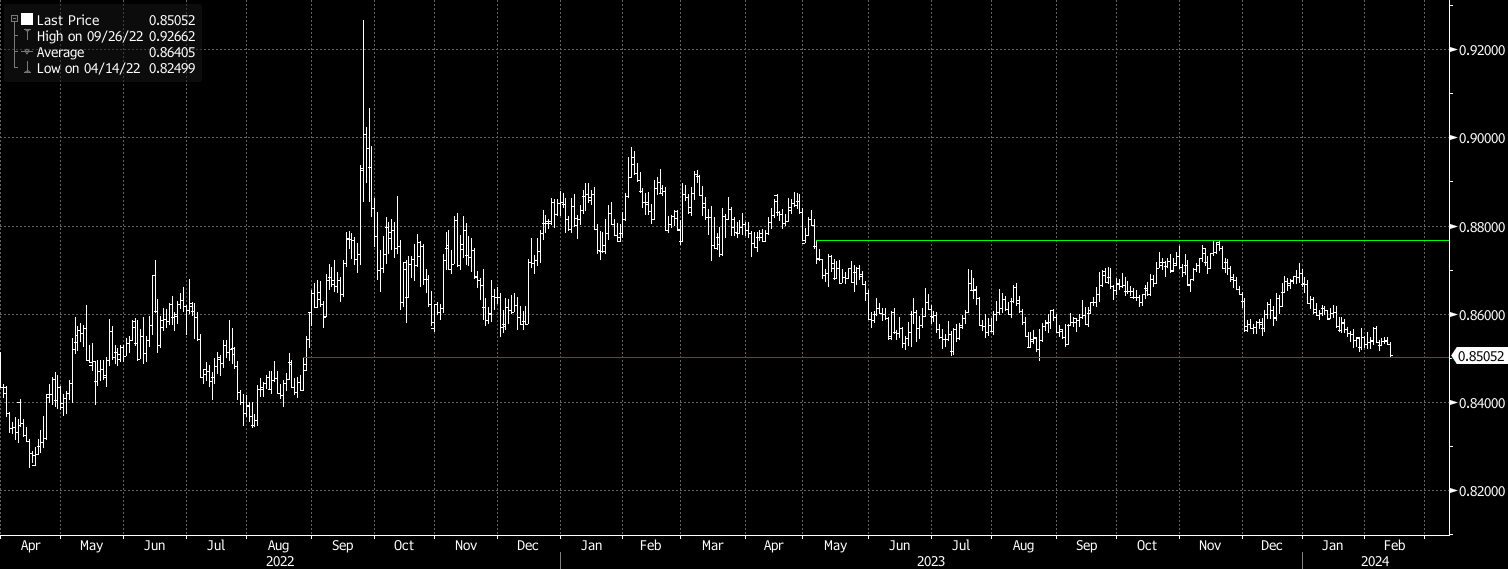

EUR/GBP has one again bounced off this huge support at 0.8500 and cannot seem to muster up enough momentum to break through this line and continue its trend lower – see chart below –

Chart of the Day – EUR/GBP – 0.8500 remains the 18 month low in EUR/GPB – see red line on chart – we have failed to break and close below this line and have subsequently bounced back above 0.8550 this week.

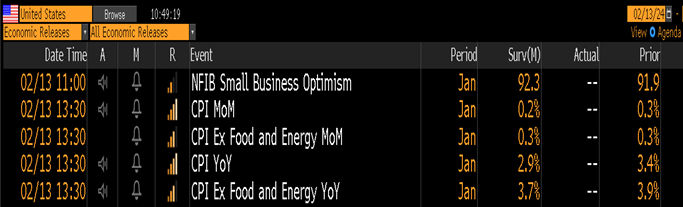

RISK EVENT – US Inflation Data – 13th Feb 2024

RISK EVENT – US Inflation Data – 13th Feb 2024

Event – US Inflation Data

Time – 1.30pm London time

Economist’s Expectations –

Importance – Very High

Implied Volatility – High

Certainty surrounding the economic release – Moderate

What’s going on?

UK and Sterling – In what has to be classified as very dull currency markets, Sterling is standing out amongst its peers. As highlighted last week, we get a series of UK economic data releases over the course of the next few days which should provide us with a real insight into the direction of play for both EUR/GBP and GBP/USD. The first of these data points were released this morning with the UK Employment Report. The UK Jobs Report come in much better that expected across the board – beating market expectations on all accounts. This saw the Pound rally versus G10 currencies – with GBP/JPY now at fresh post Brexit highs, GBP/CHF extending aggressively past 1.1060 and it feels like a matter of time before EURGBP breaks below the all-important support at 0.8510-00. Tomorrow we get the UK’s inflation report and Thursday we get the GDP release. Further strong outcomes here and the Pound should outperform – particularly versus the Euro and CHF. Weather we can push higher versus the Dollar will of course depend on this afternoon’s US Inflation report.

What the markets are looking for today – US Inflation data

The US Inflation Report today comes after the significant trimming of Federal Reserve interest rate cut expectations in the markets following the bumper payrolls report on Feb 2nd and a succession of Fed members calling for patience from the markets regarding interest rate cuts. Consensus sees core CPI print another 0.3% M/M in January and Friday’s seasonal revisions shouldn’t have materially swayed these estimates. Core CPI was revised down from 0.31 to 0.28% M/M in Dec but with the three-month average unchanged at 3.3% annualized. Core services were revised lower meanwhile, including the “supercore” down from 4.3% to 4.0% annualized over three months. It still sees a large wedge to the PCE supercore though, tracking 2.2% annualized in December (prior to revisions). As such, specific CPI implications for PCE are again likely to help set the tone for market reaction.

Outcomes –

This afternoon’s data release will be pretty binary when it comes to the Dollar and where EUR/USD and GBP/USD finish the day. A strong inflation figure and the Dollar rallies versus G10, a weaker one and we sell off. It does feel however that the currency markets will be impacted more significantly on a weaker figure = lower Dollar.

EUR/GBP – The cross sits right on major support post better than expected UK Jobs Report this morning – red line on chart. We have not been below this support for 18 months – a break and weekly close below would be very significant.