Month: July 2022

Chasing Cable

GBP/USD

We slipped below the 1.20 level in Cable at the beginning of July and have traded the majority of the month below this level – pls see chart. As you can see from the chart below the market has found it very hard to trade back above this 1.2090-1.2100 level, which has become decent resistance on the topside. The faith of the Sterling has been in the hands of the Dollar for most of this year, as the Dollar rallied against all G10 currencies. Of late we have had a number of positive economic signs out of the UK – for example, the PMI releases last Friday, which were markedly better than those out of the US and Europe – this has helped the Sterling moderately, however, its real faith will boil down to the Federal Reserve Interest Rate Decision this evening in the US at 7.00 pm London time. The market has priced in a 75 bps increase to interest rates and a hawkish press conference at 7.30 pm to follow. Any deviation from this should give Sterling a boast and help establish it firmly above the 1.2100 level.

GBP/USD has been trading below the 1.20 level for the majority of July and coming up against resistance at 1.2190-1.2100 – see red

Euro versus Sterling and the Dollar – All eyes on the Federal Reserve Interest Rate Decision.

All eyes are on the Federal Reserve Interest Rate Decision.

We are seeing very quiet markets ahead of the main risk events this week, most notably the Federal Reserve’s interest rate decision meeting in the US on Wednesday 27th July – The announcement on whether they hike interest rates by 50 or 75 bps will be made at 7.00 pm London time, with a press conference to follow from Fed Chair Powell at 7.30 pm. A hugely important interest rate decision for the global markets, as the Fed tends to set the tone for the rest of the G10 central banks to follow – we believe they will hike interest rates by 75 bps, however, we may see some concerning language from Chair Powell in the press conference afterwards, following a number of concerning economic releases out of the States over the course of July. These include jobs claims data trending higher, alongside concerning updates on hiring from Apple, Microsoft and Shopify, weak Philly Fed and then a terrible PMI print last Friday too, contributing to some respite in the uptrend in the Dollar versus all other currencies bar the Euro.

Financial markets are generally experiencing a summer lull ahead of tomorrow evening’s announcement – all bar the Euro in fact. The Euro’s woes continued on Tuesday, as other headlines hit the wires concerning gas supply from Russia to Europe – KREMLIN SAYS ‘SOME PROBLEMS’ WITH ANOTHER NORD STREAM TURBINE. This pressure on the Euro came despite the agreement earlier in the day by EU member states – EU COUNTRIES AGREE TO REDUCE GAS USE FOR NEXT WINTER. The Euro has sold off against both the Dollar and Sterling, with EUR/GBP approaching some interesting levels – see charts below.

EUR/GBP has sold off over 2% since last Thursday and is approaching this 0.8400 (1.1905 in GBP/EUR terms) level. A level we have not been below since the beginning of May – red line in the chart below –

EUR/USD struggles to gain further traction above 1.02 and has slipped below initial support at 1.0120 – (red line) – is parity calling once again…..?

ECB Rate Decision – Hike 50 bps

ECB Rate Decision – Hike 50 bps

The European Central Bank hiked interest rates this afternoon by half a percentage point – leaving the main refinancing rate at 0.50% and the deposit rate now sits at 0.00%. This is the first time the ECB has raised rates in over a decade and is a very significant move by the central bank, with wide-ranging implications for all those residing in the European Union. The ECB also introduced a new monetary policy tool at today’s meeting – Transmission Protection Instrument or TPI – essentially it allows them to hike interest rates without the spreads between the periphery government bonds widening out versus the core countries’ government bonds – we saw this during the Euro Crisis. It led to higher and higher borrowing costs for the periphery countries.

Today’s decision confirms to the market that the ECB is now more concerned with fighting inflation in the immediate future than had previously been priced in or about it being predictable – as expressed by President Lagarde in her press conference today – LAGARDE: SIGNS OF HIGHER INFLATION EXPECTATIONS NEED MONITORING.

Lagarde, whilst relatively sanguine about the economic outlook for the Eurozone Area, did also suggest that recent data may be pointing to a slowing of economic activity. This leads us to the unusual situation of the Central Bank hiking interest rates in a slowing economy. Of course, this is not ideal; however, the fight against rocking inflation has forced them to do so.

European assets have a mixed reaction on the day, with bond markets rallying, bar Italy and Equity markets fairly flat on the session. Euro initially rallied versus the Dollar and Sterling on the surprise 50 bps hike, but has subsequently mean reverted back to its pre-ECB interest rate decision levels – see charts below. However, we do not see us closing the week at these levels and feel we see further volatility into tomorrow’s trading session.

EUR/USD – spike higher on the initial market surprise to the 50 bps hike and subsequent sell-off into the close

EUR/GBP – similar price action to EUR/USD.

Euro and Sterling – Showing glimpses of life…….

Euro and Sterling – Showing glimpses of life…….

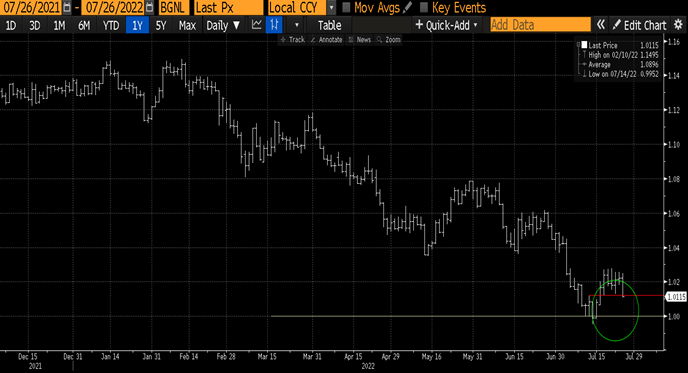

As we have highlighted in our weekly currency market reports over the course of the past 6 months, the volatility in the FX markets has dramatically increased. The price action in G10 currency pairs over the past few weeks has demonstrated the need to have a robust Forex hedging strategy in place. Even if we focus in on the past 2 weeks alone, as EUR/USD broke parity to trade a low of 0.9952 last week – the lowest it’s been in over 2 decades – we have subsequently traded over 3% higher this week in the single currency, as the Dollar takes a respite and some of the immediate concerns regarding the Euro have dissipated ahead of the all-important ECB interest rate policy meeting tomorrow.

EUR/USD – 2022 snap shot of volatility

The ECB monetary policy committee will announce their decision on interest rates tomorrow at 1.15pm London time, with a press conference to follow at 1.45 pm by President Lagarde. The board is widely anticipated to raise interest rates for the first time in over a decade tomorrow afternoon. We have had sources leaks this week from the ECB, suggesting that the Central Bank might surprise the financial markets and increase interest rates by 50 bps instead of the widely expected 25 bps hike. A 50 bps hike would be a much more hawkish outcome and we would need to watch the currency rallying back through the all-important break down level at 1.0350 – see chart below.

Euro break down level at 1.0350- highlight below with the purple line – this old support, has now turned into new resistance

Either way the interest rate decision by the ECB tomorrow, along with information regarding the new monetary policy tool, to be introduced by the Central Bank, to help curb a widening of government bond spreads between the core and periphery countries within the EU will be closely monitored.

We focus on the Euro in this report, as its price action over the next few trading sessions following the ECB will have a major impact on Sterling and other currencies versus the Dollar going forward. Euro should set the scene for other major G10 currencies and hence our focus on it this week. As mentioned above both Euro and Sterling have rallied nicely versus the Dollar this week – leaving the currency pair EUR/GBP to tread water this week.

The million dollar question is though whether these rallies in Euro and Sterling can be sustained or whether there will be a resumption of the Dollar rally. We believe tomorrow’s ECB meeting will give us a very good insight into this……. Worth watching.

Disclaimer

The content of this report is for information purposes only. Nothing in this report should be considered financial, investment, legal, tax or other advice nor should it be interpreted as a recommendation to buy or sell foreign currency or any other products or services. Readers must carefully make their own decisions based upon their specific objectives and financial positions.

Treasury First is powered by Assure Hedge (UK) Limited, a company incorporated in England and Wales (No.10723112) with its registered office at 45 Eagle Street, London WC1R 4FS, UK, is authorised and regulated by the Financial Conduct Authority of the UK (FRN:783837). Assure Hedge Limited, the parent company, is incorporated in Ireland (No. 578153) with its registered office at Dogpatch Labs, CHQ Building, North Wall Quay, Dublin 1, Ireland.