Month: January 2022

Sterling in Focus

Sterling in Focus this week

The global stocks markets and in particular the US stock markets are experiencing very high volatility to start the year off. A combination of geopolitical woes – the Ukrainian crisis and rising global interest rates are behind this volatility. This unease in the markets is filtering through in other asset classes and currencies are not immune to the unrest.

During periods of high volatility and ‘’risk-off’’ in the financial markets, Sterling historically tends to trade badly. GBP/USD will trade lower and EUR/GBP will trade higher. We are seeing this pattern emerge over the past few days as global equity markets take a tumble – from its highs in January the Nasdaq 100 has sold off over 17%. Given Sterling’s rally so far in January, this brings the Pound into focus this week and it fights several potential headwinds.

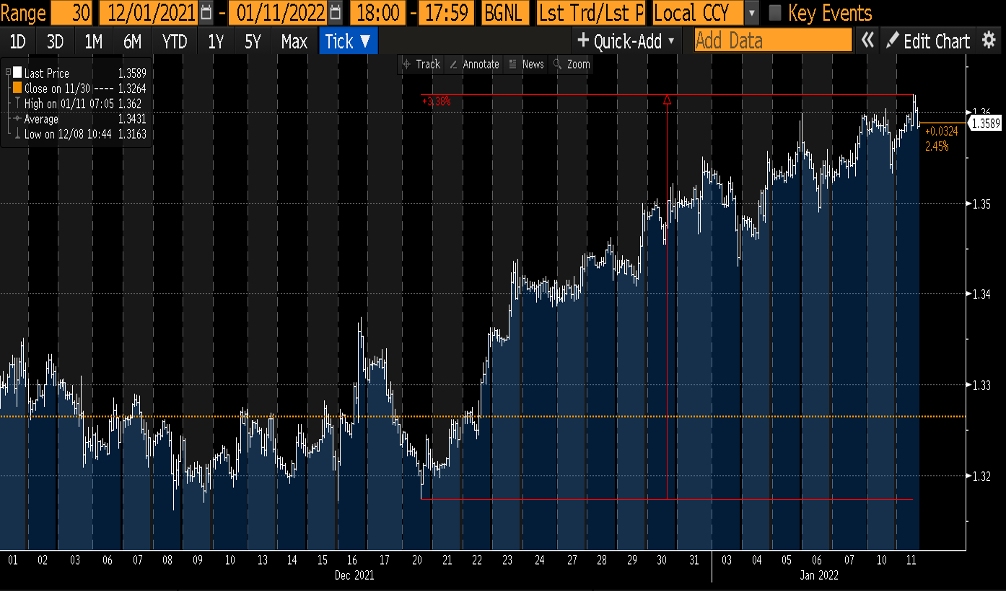

In the chart below we can see how Sterling has sold off over the past few trading sessions and is also approaching its 50 day moving average in GBP/USD.

The volatility in the financial markets is of concern for Sterling bulls as highlighted above, however, there are several Sterling centric issues also coming into play this week.

Market positioning – the pound had started 2022 with the market holding a heavy short position. We failed to make any further progress lower and these positions got squeezed out, as Sterling began to rally at the beginning of the year. This positioning has largely been washed out of the market and is no longer acting as a Sterling positive. As we approach the end of the month, the natural flow dynamics of the market have changed. Firstly the FTSE has been a stand-out performer in the global equity space in January and therefore we should see Sterling supply in the markets as Global portfolio managers rebalance their books at the end of the month. We should also see some Sterling supply as BHP Billiton removes its dual listing in the UK.

Now thrown in on top of all this, the political folly surrounding Boris Johnson in the UK and the Gray report, with a potential leadership challenge, and we could well have the perfect storm for a lower pound into month-end. Watch this space…..

From the chart below we can see how Sterling has sold off and Euro has rallied in the face of increased financial volatility – the 50 day moving average – line in pink – is now acting as technical resistance.

Disclaimer

The content of this report is for information purposes only. Nothing in this report should be considered financial, investment, legal, tax or other advice nor should it be interpreted as a recommendation to buy or sell foreign currency or any other products or services. Readers must carefully make their own decisions based upon their specific objectives and financial positions.

Treasury First is powered by Assure Hedge (UK) Limited, a company incorporated in England and Wales (No.10723112) with its registered office at 45 Eagle Street, London WC1R 4FS, UK, is authorised and regulated by the Financial Conduct Authority of the UK (FRN:783837). Assure Hedge Limited, the parent company, is incorporated in Ireland (No. 578153) with its registered office at Dogpatch Labs, CHQ Building, North Wall Quay, Dublin 1, Ireland.

Central Banks Continue to Dominate

Central Banks Continue to Dominate

Following on from our report last week, we will start today’s currency report by checking in on EUR/GBP. We mentioned last week that we would be monitoring this currency pair closely for signs of a continuation of the trend lower in Euro and of course conversely higher in Sterling.

We mention this all important 1.20 level in GBP/EUR terms, which comes in at 0.8333 in EUR/GBP. We have attempted to break the level and close below since the first trading day of January – however, we have failed to get a close below the 0.8333/above 1.20. As you can now see from the chart below – technically it would appear that EUR/GBP is forming a short term base at 0.8333 and now looking to break out of the recent range to the topside. 0.8381 is now the pivot to the topside and should provide initial resistance.

A clean break above this level opens up the 0.84 zone, a break of which would add further momentum to the topside. The overall medium term down trend in EUR/GBP is still intact, however, given we could not break and close below 0.8333 (GBP/EUR 1.20) in the short term, may mean we see a bounce in EUR/GBP for a week or so, before we can resume the downtrend.

The dominant theme for 2022 will be the actions of global central banks and the enormous impact these actions will have on the financial markets. Global central banks are pivoting away from monetary stimulus, with many signaling they are entering the beginning of an interest rate hike cycle – mostly notably the US Federal Reserve.

We have become accustomed to interest rates at zero and low levels of volatility in the currency markets over the past number of years. With central banks indicating they are looking to increase interest rates and therefore interest rate differentials coming into play amongst currency pairs, we should in theory see increased volatility in the currency markets over the course of 2022.

The market can get a little ahead of itself with this theme as seen in EUR/USD over the past number of trading sessions. Euro has rallied since early last week – nearly 2%, as the market turned its attention to the ECB and its concern over rising inflation – see chart.

It appears that the market was too quick to place the ECB into the bucket of central banks on the verge of hiking and we have seen a subsequent retracement of the rally last week. This now appears to be a false break higher in Euro as we fall back below the important pivot at 1.1380 – see chart.

Disclaimer

The content of this report is for information purposes only. Nothing in this report should be considered financial, investment, legal, tax or other advice nor should it be interpreted as a recommendation to buy or sell foreign currency or any other products or services. Readers must carefully make their own decisions based upon their specific objectives and financial positions.

Treasury First is powered by Assure Hedge (UK) Limited, a company incorporated in England and Wales (No.10723112) with its registered office at 45 Eagle Street, London WC1R 4FS, UK, is authorised and regulated by the Financial Conduct Authority of the UK (FRN:783837). Assure Hedge Limited, the parent company, is incorporated in Ireland (No. 578153) with its registered office at Dogpatch Labs, CHQ Building, North Wall Quay, Dublin 1, Ireland.

Sterling Hits 1.20

Sterling Hits 1.20, can it go any further?

The New Year has brought a further bout of Sterling strength in the currency markets. This strength initially manifested itself in GBP/USD over the festive period as can been seen from the short term chart below – Dec 20th onwards and subsequently filtered through into GBP/EUR – higher Sterling

GBP/EUR has a seasonal tendency to trend in the first couple of months of the year and in this case we are seeing a further extension to the higher trend that emerged at the beginning of last year. There are of course many reasons to be bearish Sterling as a whole, however as it stands, we are potentially seeing a trend higher in Sterling emerge. This trend is not confirmed as of yet and we will be watching a number of indicators over the coming weeks closely – which we will highlight – that should confirm or not the higher GBP/EUR trade.

The first of these sign posts is the big technical level in GBP/EUR at 1.20 – this equates to 0.8333 in EUR/GBP terms. This is a huge psychological level in the currency pair and as can be seen from the longer term chart below, a level we have not been above in over 20 months.

We have made a number of attempts to clear this level since the beginning of the year – each day since the 4th Jan we have hit resistance near 1.20 – see short term GBP/EUR chart below. It is very likely that the reason behind these failed attempts at the 1.20 level has been Sterling supply from the corporate world. Traditionally the corporate sector will hedge their FX exposure in and around important levels like 1.20. Given we have not been at this level in over 20 months, it makes sense that Treasurers are using this opportunity to off load their pounds at good levels and mitigate their FX exposure.

So this is our first major sign post that will help indicate whether we are in a larger up-trend in GBP/EUR or whether we will fall back into the range. A weekly close above 1.20 is needed – watch this space.

Treasury First is powered by Assure Hedge (UK) Limited, a company incorporated in England and Wales (No.10723112) with its registered office at 45 Eagle Street, London WC1R 4FS, UK, is authorised and regulated by the Financial Conduct Authority of the UK (FRN:783837). Assure Hedge Limited, the parent company, is incorporated in Ireland (No. 578153) with its registered office at Dogpatch Labs, CHQ Building, North Wall Quay, Dublin 1, Ireland.

This email and any files transmitted with it are confidential and intended solely for the use of the individual or entity to whom it is addressed. If you have received this email in error, immediately notify the sender by reply email and then permanently delete this email and your reply. Unauthorised use, disclosure, storage or copying of this email is not permitted. Whilst every endeavour is taken to ensure that emails are free from viruses, no liability can be accepted for any damage arising from using this email. Treasury First does not guarantee the accuracy or reliability of information in this message, and any views expressed are not necessarily the views of the company.