Category: Market Update

Sterling – Still causing pain – in both directions

Sterling – Still causing pain – in both directions

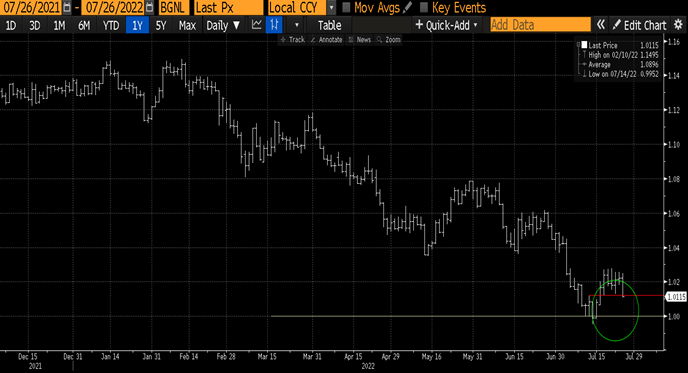

Sterling’s wild swings in the currency markets are causing all kinds of pain for those exposed – on the way down and on the way back up again in recent weeks. This is when a robust hedging strategy comes into its own and can help smoothen out these extremely volatile periods.

Sterling’s volatile swings over the past 3 weeks – both down and back up again.

Let’s take a step back –

Sterling is grabbing all the headlines of late and rightly so, as the idiosyncratic stories dominating UK politics are leading to outsized moves in UK asset classes – particularly FX. Although domestic issues are having their impact, Sterling is still being pushed and pulled around by the broader market dynamics – giving its moves added venom. This week’s price action in the currency markets has been an excellent example of this. We are ultimately (the wider G10 currencies) – being dragged around by risk on/risk off market dynamics.

Risk on – this environment is dominated by rallying equity markets, lower levels in the Dollar, higher commodities and bonds selling off

Risk off – this environment is dominated by weak equity markets, a higher Dollar, lower commodities and a rallying bond market

This week opened up on a positive note – risk on, which saw the Dollar sell-off across the board. This was hugely exaggerated when it comes to Sterling, which rally some 3.6% from Monday to Wednesday morning. Clearly, some of the GBP/USD strength was due to positive domestics developments – the U-turn on higher tax cuts from the Chancellor, however, it was also due to the weakness in the Dollar, as can be seen with the Euro, which rallied nearly 5 big figures versus the Dollar to trade just shy of parity, yesterday evening – see chart below –

Euro’s performance since last Thursday versus the Dollar – rallying nearly 4% off the lows, just shy of the parity mark.

Unfortunately, this volatile period looks set to stay for the immediate future. There is very little on the immediate horizon to give us clarity over the global inflation problem, the global energy crisis and onset of winter in the northern hemisphere, the Ukrainian war and geo-political tensions and of course the threat of a potential global recession, in the midst of global interest rate hiking cycle. What we can do is observe some important levels in the major currency pairs, a break of which should give us further insight into future, more medium-term directions.

EUR/USD Levels – to watch

Topside – 1.00 and 1.02

Downside – 0.9530

GBP/USD Levels – to watch

Topside – 1.1500 and 1.1750

Downside – 1.10 and 1.0350

EUR/GBP Levels – to watch

Topside – 0.9065 and 0.9266

Downside – 0.8650 and 0.8600

We can of course also look ahead to any major risk events ensuring we are fully aware of their potential impact on the markets.

This week we have employment figures out of the US on Friday and their inflation print next week on Thursday the 13th. These are the two most important figures out of the US in October and should be closely monitored for their impact on the FX markets.

An Aside –

Worth mentioning the dreaded word – Brexit here – on a positive note for once – there are a few positive noises circulating with regards to the creation of the EPC (European Political Community) of which the UK is to be a member. Liz Truss even attended its inaugural meeting this week which could pave the way for a more cohesive approach down the road….. Fingers crossed.

Treasury First does not guarantee the accuracy or reliability of the information in this message, and any views expressed are not necessarily the views of the company.

Treasury First is powered by Assure Hedge (UK) Limited, a company incorporated in England and Wales (No.10723112) with its registered office at 45 Eagle Street, London WC1R 4FS, UK, is authorised and regulated by the Financial Conduct Authority of the UK (FRN:783837). Assure Hedge Limited, the parent company, is incorporated in Ireland (No. 578153) with its registered office at Dogpatch Labs, CHQ Building, North Wall Quay, Dublin 1, Ireland.

A Wild Week in the Forex Markets

We highlighted last week in our ‘’Central Bank Showdown’’ report that this week could be extremely volatile for the foreign exchange markets. With no less than 9 major central bank interest rate decisions on the cards spread over Wednesday and Thursday, the likelihood of some wild moves was very high. The risk events did not disappoint and FX markets have experienced unprecedented volatility this week.

The movers and shakers have been JPY, GBP and Euro – in that order. The JPY appreciated versus the Dollar, with Sterling and the Euro depreciating further. Sterling is clearly winning the ugly contest hands down…..

Japanese Yen – Intervention

The Ministry of Finance in Japan conducted an unprecedented Forex intervention into its currency on Thursday of this week. This was the first time the Govt have intervened to protect its currency since 1998. The USD has appreciated versus the JPY by over 28% this year alone – forcing the Japanese Government to intervene in the currency markets and sell Dollars in an effort to strengthen their currency – see chart below

USD/JPY’s price action on Thursday when the Japanese Govt intervene in the currency markets –

Sterling – Zero Friends

The 50 bps interest rate hike from the Bank of England this week, taking interest rates in the UK to 2.25%, did little to assist the currency. The market is now pricing in interest rates to peak in the UK at 5.25% in June of next year. UK financial assets are trading in a manner akin to an emerging market – the currency is selling off – down nearly 20% alone this year versus the Dollar, UK bonds are selling off and the UK stock markets are also selling off. This morning the UK Chancellor provided details to parliament on the emergency fiscal measure to be introduced over the coming weeks – this mini-budget will add a further £161 billion to the deficit over 10 years. It may be an underestimate to suggest the market has not reacted well to this announcement, with Sterling selling off quite dramatically versus both the Dollar and Euro – please see the charts below.

GBP/USD – trading at levels not seen since 1985

EUR/GBP – firmly breaking higher out of its yearly range

Treasury First does not guarantee the accuracy or reliability of the information in this message, and any views expressed are not necessarily the views of the company.

Treasury First is powered by Assure Hedge (UK) Limited, a company incorporated in England and Wales (No.10723112) with its registered office at 45 Eagle Street, London WC1R 4FS, UK, is authorised and regulated by the Financial Conduct Authority of the UK (FRN:783837). Assure Hedge Limited, the parent company, is incorporated in Ireland (No. 578153) with its registered office at Dogpatch Labs, CHQ Building, North Wall Quay, Dublin 1, Ireland.

Chasing Cable

GBP/USD

We slipped below the 1.20 level in Cable at the beginning of July and have traded the majority of the month below this level – pls see chart. As you can see from the chart below the market has found it very hard to trade back above this 1.2090-1.2100 level, which has become decent resistance on the topside. The faith of the Sterling has been in the hands of the Dollar for most of this year, as the Dollar rallied against all G10 currencies. Of late we have had a number of positive economic signs out of the UK – for example, the PMI releases last Friday, which were markedly better than those out of the US and Europe – this has helped the Sterling moderately, however, its real faith will boil down to the Federal Reserve Interest Rate Decision this evening in the US at 7.00 pm London time. The market has priced in a 75 bps increase to interest rates and a hawkish press conference at 7.30 pm to follow. Any deviation from this should give Sterling a boast and help establish it firmly above the 1.2100 level.

GBP/USD has been trading below the 1.20 level for the majority of July and coming up against resistance at 1.2190-1.2100 – see red

Euro versus Sterling and the Dollar – All eyes on the Federal Reserve Interest Rate Decision.

All eyes are on the Federal Reserve Interest Rate Decision.

We are seeing very quiet markets ahead of the main risk events this week, most notably the Federal Reserve’s interest rate decision meeting in the US on Wednesday 27th July – The announcement on whether they hike interest rates by 50 or 75 bps will be made at 7.00 pm London time, with a press conference to follow from Fed Chair Powell at 7.30 pm. A hugely important interest rate decision for the global markets, as the Fed tends to set the tone for the rest of the G10 central banks to follow – we believe they will hike interest rates by 75 bps, however, we may see some concerning language from Chair Powell in the press conference afterwards, following a number of concerning economic releases out of the States over the course of July. These include jobs claims data trending higher, alongside concerning updates on hiring from Apple, Microsoft and Shopify, weak Philly Fed and then a terrible PMI print last Friday too, contributing to some respite in the uptrend in the Dollar versus all other currencies bar the Euro.

Financial markets are generally experiencing a summer lull ahead of tomorrow evening’s announcement – all bar the Euro in fact. The Euro’s woes continued on Tuesday, as other headlines hit the wires concerning gas supply from Russia to Europe – KREMLIN SAYS ‘SOME PROBLEMS’ WITH ANOTHER NORD STREAM TURBINE. This pressure on the Euro came despite the agreement earlier in the day by EU member states – EU COUNTRIES AGREE TO REDUCE GAS USE FOR NEXT WINTER. The Euro has sold off against both the Dollar and Sterling, with EUR/GBP approaching some interesting levels – see charts below.

EUR/GBP has sold off over 2% since last Thursday and is approaching this 0.8400 (1.1905 in GBP/EUR terms) level. A level we have not been below since the beginning of May – red line in the chart below –

EUR/USD struggles to gain further traction above 1.02 and has slipped below initial support at 1.0120 – (red line) – is parity calling once again…..?

ECB Rate Decision – Hike 50 bps

ECB Rate Decision – Hike 50 bps

The European Central Bank hiked interest rates this afternoon by half a percentage point – leaving the main refinancing rate at 0.50% and the deposit rate now sits at 0.00%. This is the first time the ECB has raised rates in over a decade and is a very significant move by the central bank, with wide-ranging implications for all those residing in the European Union. The ECB also introduced a new monetary policy tool at today’s meeting – Transmission Protection Instrument or TPI – essentially it allows them to hike interest rates without the spreads between the periphery government bonds widening out versus the core countries’ government bonds – we saw this during the Euro Crisis. It led to higher and higher borrowing costs for the periphery countries.

Today’s decision confirms to the market that the ECB is now more concerned with fighting inflation in the immediate future than had previously been priced in or about it being predictable – as expressed by President Lagarde in her press conference today – LAGARDE: SIGNS OF HIGHER INFLATION EXPECTATIONS NEED MONITORING.

Lagarde, whilst relatively sanguine about the economic outlook for the Eurozone Area, did also suggest that recent data may be pointing to a slowing of economic activity. This leads us to the unusual situation of the Central Bank hiking interest rates in a slowing economy. Of course, this is not ideal; however, the fight against rocking inflation has forced them to do so.

European assets have a mixed reaction on the day, with bond markets rallying, bar Italy and Equity markets fairly flat on the session. Euro initially rallied versus the Dollar and Sterling on the surprise 50 bps hike, but has subsequently mean reverted back to its pre-ECB interest rate decision levels – see charts below. However, we do not see us closing the week at these levels and feel we see further volatility into tomorrow’s trading session.

EUR/USD – spike higher on the initial market surprise to the 50 bps hike and subsequent sell-off into the close

EUR/GBP – similar price action to EUR/USD.

Euro and Sterling – Showing glimpses of life…….

Euro and Sterling – Showing glimpses of life…….

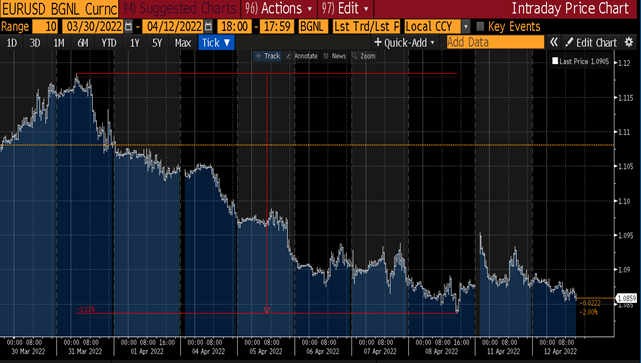

As we have highlighted in our weekly currency market reports over the course of the past 6 months, the volatility in the FX markets has dramatically increased. The price action in G10 currency pairs over the past few weeks has demonstrated the need to have a robust Forex hedging strategy in place. Even if we focus in on the past 2 weeks alone, as EUR/USD broke parity to trade a low of 0.9952 last week – the lowest it’s been in over 2 decades – we have subsequently traded over 3% higher this week in the single currency, as the Dollar takes a respite and some of the immediate concerns regarding the Euro have dissipated ahead of the all-important ECB interest rate policy meeting tomorrow.

EUR/USD – 2022 snap shot of volatility

The ECB monetary policy committee will announce their decision on interest rates tomorrow at 1.15pm London time, with a press conference to follow at 1.45 pm by President Lagarde. The board is widely anticipated to raise interest rates for the first time in over a decade tomorrow afternoon. We have had sources leaks this week from the ECB, suggesting that the Central Bank might surprise the financial markets and increase interest rates by 50 bps instead of the widely expected 25 bps hike. A 50 bps hike would be a much more hawkish outcome and we would need to watch the currency rallying back through the all-important break down level at 1.0350 – see chart below.

Euro break down level at 1.0350- highlight below with the purple line – this old support, has now turned into new resistance

Either way the interest rate decision by the ECB tomorrow, along with information regarding the new monetary policy tool, to be introduced by the Central Bank, to help curb a widening of government bond spreads between the core and periphery countries within the EU will be closely monitored.

We focus on the Euro in this report, as its price action over the next few trading sessions following the ECB will have a major impact on Sterling and other currencies versus the Dollar going forward. Euro should set the scene for other major G10 currencies and hence our focus on it this week. As mentioned above both Euro and Sterling have rallied nicely versus the Dollar this week – leaving the currency pair EUR/GBP to tread water this week.

The million dollar question is though whether these rallies in Euro and Sterling can be sustained or whether there will be a resumption of the Dollar rally. We believe tomorrow’s ECB meeting will give us a very good insight into this……. Worth watching.

Disclaimer

The content of this report is for information purposes only. Nothing in this report should be considered financial, investment, legal, tax or other advice nor should it be interpreted as a recommendation to buy or sell foreign currency or any other products or services. Readers must carefully make their own decisions based upon their specific objectives and financial positions.

Treasury First is powered by Assure Hedge (UK) Limited, a company incorporated in England and Wales (No.10723112) with its registered office at 45 Eagle Street, London WC1R 4FS, UK, is authorised and regulated by the Financial Conduct Authority of the UK (FRN:783837). Assure Hedge Limited, the parent company, is incorporated in Ireland (No. 578153) with its registered office at Dogpatch Labs, CHQ Building, North Wall Quay, Dublin 1, Ireland.

Financial Markets Showing Signs of Increased Stress

Financial Markets Showing Signs of Increased Stress;

Having sold off significantly into mid-May, global equity markets had begun to see a rebound up until Friday. We could add most risk markets to the above sentence, as the financial markets, in general, began to settle down and adjust to this new environment of higher inflation and global central banks that are hiking interest rates across the board. Friday’s higher-than-expected inflation printout of the US has seen this all turn around quite dramatically, with volatility creeping back into the stock markets, bond markets, currency markets and crypto space. Friday and Monday have seen unprecedented sell-offs, with the Dollar gaining in strength as fear once again grips the financial markets.

Sterling – hit by a strengthening Dollar and political uncertainty.

Sterling has had the misfortune of facing a double whammy over the past 2 trading sessions versus both the Dollar and Euro – GBP/USD has sold off and EUR/GBP has rallied. As fear grips the markets, the Dollar has strengthened as we see the traditional flight to quality. This Dollar strength has been further compounded when it comes to GBP/USD as we face the uncertainty of the UK bill to override certain sections of the Northern Ireland Protocol – as announced yesterday evening by Foreign Secretary Truss – we will have to wait and see the full extent of the EU’s response – a full out trade war is of course still on the table.

Cable – GBP/USD has sold off aggressively over the past 48 hrs – see chart below – well over 3.5% and below the lows seen on 8th May at 1.2156. 1.2139 was the low yesterday.

This recent sell-off in GBP/USD has brought the all-important 1.20 level into play. This is a major level of support dating back to the Brexit vote in the summer of 2016. Given the price action down at these levels over the past few years, we would expect to see longer-term buyers of Sterling to enter the market at any first attempt of this support, however a clean break and weekly close below the level would be worrying – pls see chart below.

The long-term chart of GBP/USD – dating back to the Brexit vote – red line indicating long-term support at the 1.20 level.

Despite EUR/USD selling off, the Euro has actually rallied versus Sterling and is right up against the all-important 0.86 resistance zone on the topside in EUR/GBP terms – 1.1628 in GBP/EUR terms. We have pointed out this level now on many occasions and we feel if the situation with the North Ireland Protocol was to deteriorate further, mainly led by retaliation from the EU, we would look for a significant break of the 0.86 level – which opens us the 0.88 level in EUR/GBP above.

EUR/GBP – the all-important resistance zone at 0.8600 –

Bank of England Hike Interest Rates…… the devil is in the details……….

Bank of England – a huge day in the financial markets as the Bank of England hiked rates by 25 bps, following the US Federal Reserve’s move overnight, hiking interest rates by 50bps. Finally, global central banks are on the move and actively attempting to curb inflation, which in the case of the UK is forecasted to rise to 10% this year. Central Bank monetary action of course has its own knock-on effects and is currently causing large amounts of volatility in the currency markets – price action post the Bank of England hike this afternoon is a point in case.

It is fair to say that the Bank of England achieved its goal by hiking interest rates in a very dovish manner today. The initial headline on the wires appeared quite hawkish – a 6-3 vote to hike rates by 25 bps, meaning 3 members of the MPC voted in favour of hiking interest rates by 50 bps. As mentioned above, however, the devil was very much in the detail here and the MPC’s new projections on the economic outlook, inflation and terminal interest rates, all painted a very different picture.

Short term Chart – GBP/USD – immediate price action post-BOE – initial false rally in Sterling highlighted by the red circle and subsequent collapse.

The details of the MPC’s economic forecast paint a grim picture of the UK’s outlook. Although the Bank has an inflation forecast hitting its peak in the 4th quarter of this year, at 10%, it does forecast CPI dropping off below 2% by the 3rd year of its projections. This however may be down to the recession it now forecasts in 2023 and not a positive reaction to rate hikes – it sees the economy contracting by 0.25% next year. The Governor of the Bank of England, Andrew Bailey was equally pessimistic during the subsequent press conference – the stand out comment here has to be – Bailey – sees the largest contraction in real incomes since the data began in 1964.

As you can imagine, Sterling has taken a tumble this afternoon, as the UK’s Fixed Income market rallied hard – ie interest rate expectations came in lower. On the currency front, we have sold off versus the Dollar by over 1.5% and against the Euro just under 1.5%. We are now approaching levels in Cable (GBP/USD) not seen since the summer of 2020 – the height of the pandemic –

Long term chart of Cable – 1.2258 now looks very important support on the downside – red line

Versus the Euro, we have finally broken out of the yearly range that has defined us since January – albeit marginally – the 0.8510-20 zone. We would need a weekly close above here however to confirm the breakout. We would also like to point out that moves like this on a BOE rate decision days have not been sustained so far this year – so all eyes are on the close in EUR/GBP tomorrow evening.

Long term EUR/GBP chart – daily break out of yearly defining range – red line

Fickle FX Markets, Why is the Euro Weakening?

Why so weak……? The single currency (EURO) takes another lurch lower versus the Dollar and Sterling.

How fickle these FX markets can be and how quickly they can reverse current trends. As we have mentioned on numerous occasions now, we envisage this FX volatility to increase over the coming years, as Central Banks battle with interest rate hiking cycles and the ever-growing global inflationary fears.

Just last week we spoke about Euro strength versus the Dollar and Sterling – in particular as EUR/GBP was banging up against the top of its yearly range and primed to break out above 0.8500 or in GBP/EUR terms, below 1.1765. Just 7 trading sessions later and the picture is very different, as EUR/USD sits just above the 1.08 level, the lows seen during the earlier stages of the Ukrainian war and a level not traded below since earlier 2020.

EUR/USD Long Term Chart –

The past 7 trading sessions have brought the perfect storm for a weaker Euro. The US yield curve – the market’s expectations of interest rates in the US – has rallied significantly over this period – the expectation of higher interest rates in the future has increased. The catalyst for this move was a speech from Fed Vice Chair Brainard this day last week – where she suggested the US interest rate hiking cycle and the reduction of the Fed’s balance sheet might be more aggressive than the market had currently priced in. This move in US yields fed into the currency and the Dollar rallied across the board. This came as Europe grappled with Russian oil sanctions and the first round of the French presidential elections – both of which increased the fear premium in the Euro – adding selling pressure. To add to its woes the single currency battled news of further lockdowns in some major cities in China due to Covid – this muddies the future global growth story and tends to affect Europe first.

EUR/USD – Short Term Chart – 1.1190 down to 1.0840 – over 3% in 7 days.

This weakness fed into EUR/GBP also, as the market was caught long towards the yearly highs of 0.8500 in anticipation of a break of the recent range.

EUR/GBP – Short Term Chart – 0.8500 to 0.8300 the recent range

So once again we found ourselves watching major levels in EUR/USD and EUR/GBP – however this week on the downside. Watch a break and daily close below 1.08 for further momentum to the downside in EUR/USD and a break and weekly close below 0.8300 in EUR/GBP for a continuation of the recent trend lower.

Disclaimer

The content of this report is for information purposes only. Nothing in this report should be considered financial, investment, legal, tax or other advice nor should it be interpreted as a recommendation to buy or sell foreign currency or any other products or services. Readers must carefully make their own decisions based upon their specific objectives and financial positions.

Treasury First is powered by Assure Hedge (UK) Limited, a company incorporated in England and Wales (No.10723112) with its registered office at 45 Eagle Street, London WC1R 4FS, UK, is authorised and regulated by the Financial Conduct Authority of the UK (FRN:783837). Assure Hedge Limited, the parent company, is incorporated in Ireland (No. 578153) with its registered office at Dogpatch Labs, CHQ Building, North Wall Quay, Dublin 1, Ireland.

The Impact of War

Currency Markets – The Impact of war

Global financial markets are feeling the violent impact of war – both Global bond markets and global equity markets have experienced high volatility this week, with commodities screaming higher, led by oil and on the back of supply chain issues. All of this brings growth concerns to the fore and of course, adds further fuel to the fire that rages under inflation across the globe.

We mentioned last week that currency markets were experiencing a lot of noise – with kneejerk moves in both directions as the market absorbed the headlines surrounding the developing Ukrainian invasion. This week we have seen the global currencies differentiate themselves – in general, commodity currencies and producers of energy have done well. Importers of energy have struggled, along with those geographically closest to the conflict. The likes of HUF, PLN and CZK and of course the Euro and Sterling – see the chart of USD/HUF below;

USD/HUF weekly chart – HUF has depreciated over 6% this week

The single currency (Euro) and Sterling have been heavily sold this week, predominately versus the Dollar and commodity currencies like AUD, CAD and NZD. GBP/USD sold off to a new yearly low of 1.3272 on Tuesday before recovering. Sterling remains vulnerable in this environment, not only from an energy stance but also due to the extent of Russian wealth entwined in the UK economy. Given how Eurocentric this situation is, it also makes sense that the market is selling EUR/USD – see weekly chart below

EUR/USD weekly chart –

With both Euro and Sterling being sold this week versus other currencies, the actual currency pair EUR/GBP has been relatively stable for the majority of the trading sessions this week. Over the past 12 hrs however we have seen Sterling gain the upper hand – remember Sterling does have a hawkish central bank in its corner – the Bank of England should hike interest rates by another 25 bps this month. EUR/GBP has pushed below the 0.8300 level and taking is nicely above the 1.2000 level in GBP/EUR terms – the high on the day has been 1.2084. A weekly close below 0.8300 in EUR/GBP would be very significant and should add further downward pressure on the currency pair. We have been here before though – see long term chart of EUR/GBP below – We have bounced off this zone many times post-Brexit from 2016 and until we significantly break 0.8250 – red line on the chart -EUR/GBP remains technically within its 6 yr range – albeit rubbing its belly along the bottom of that range…….

Disclaimer

The content of this report is for information purposes only. Nothing in this report should be considered financial, investment, legal, tax or other advice nor should it be interpreted as a recommendation to buy or sell foreign currency or any other products or services. Readers must carefully make their own decisions based upon their specific objectives and financial positions.

Treasury First is powered by Assure Hedge (UK) Limited, a company incorporated in England and Wales (No.10723112) with its registered office at 45 Eagle Street, London WC1R 4FS, UK, is authorised and regulated by the Financial Conduct Authority of the UK (FRN:783837). Assure Hedge Limited, the parent company, is incorporated in Ireland (No. 578153) with its registered office at Dogpatch Labs, CHQ Building, North Wall Quay, Dublin 1, Ireland.